We're hiring! Discover our culture and explore open roles.

Reference Rates.

Enterprise-grade BMR-compliant single-asset reference rates.

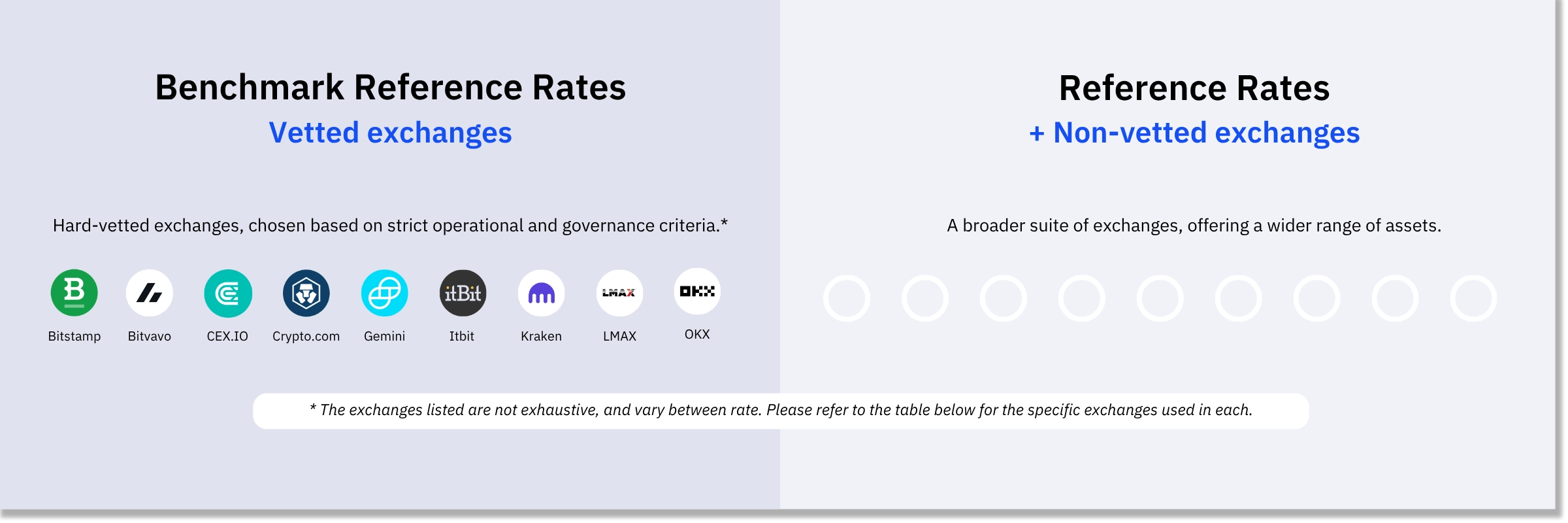

Our Reference Rate Families

Benchmark

Reference Rates

BMR-Compliant rates built from hard-vetted exchanges using strict operational and governance criteria.

Reference

Rates

Rates built from alternative exchanges, offering compliant rates for a wider range of assets.