Join us in Cannes for our Institutional Conference this Spring

Data Infrastructure Powers the Next Generation of On-Chain Markets

Kaiko’s institutional-grade price feeds enabled Markets by Kinetiq to achieve the fastest growth trajectory among HIP-3 DEXs, processing $300M in the first 10 days.

- Markets by Kinetiq became the 2nd largest HIP-3 DEX by volume in week one

- Deep liquidity and tight spreads across TradFi asset perpetuals demonstrate the importance of strong infrastructure

- First platform to offer on-chain liquidation heatmaps, L4 order book data, and verified trader positions for traditional assets

- Regulated benchmark rates unlock 24/7 trading of global equities and commodities

Launch Metrics Reveal Infrastructure Advantage

The launch of Kinetiq’s Markets represents more than another perpetual DEX entering an already crowded landscape. The platform’s explosive first 10 days, processing approximately $300M in volume while maintaining institutional-level liquidity across TradFi assets, demonstrates what becomes possible when reliable data infrastructure meets DeFi execution rails.

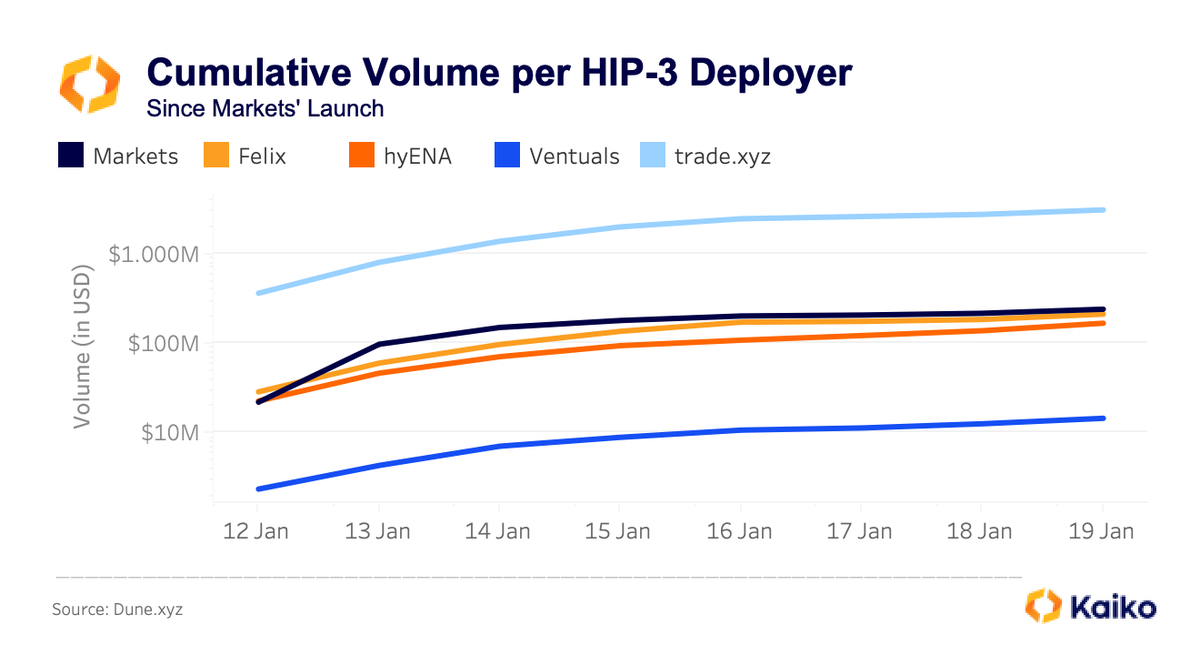

Markets launched with unseen velocity. The platform became the second-largest HIP-3 DEX by volume on its first day, a trajectory that typically requires weeks or months of bootstrapping liquidity and user acquisition. More striking, it achieved $100M in cumulative volume within 48 hours, the fastest among HIP-3 venues.

The platform’s growth rate compounds these initial metrics. As the fastest-growing HIP-3 DEX, Markets demonstrates sustained rather than event-driven adoption, a pattern typically associated with product-market fit rather than speculative interest. Despite being the newest entrant in the HIP-3 ecosystem, Markets has outpaced deployers that have more listings and multi-month head starts.

Liquidity begets liquidity

Volume alone tells an incomplete story. Market depth across listings consistently exceeds comparable platforms, with market depth rarely dropping below levels that would create execution risk for large-sized orders. Spread consistency during the first 10 days remained tight even during volatile sessions, indicating robust infrastructure rather than opportunistic liquidity provision.

The platform maintains the second-deepest order books in this daily snapshot at both the 50 basis point and 100 basis point levels, indicating healthy liquidity not just at the mid-price but throughout the executable range where institutional-sized orders typically execute. Complementing this depth, Markets also ranks second in median spread metrics, demonstrating that its liquidity is both deep and efficiently priced. For traders, this translates directly to lower execution costs and reduced slippage on larger orders.

Zooming in on spreads, Markets maintains tight and consistent execution, with the spreads on the Tesla pair widening only 29% from 3.10 bps during market hours to 4.00 bps during off-hours.

The Infrastructure Layer

Traditional perp markets for global equities and commodities face an inherent constraint. When equity markets close for the day, an on-chain perpetual must somehow maintain accurate pricing without live reference data. When commodity exchanges go dark for the weekend, continuous futures contracts need a mechanism to determine fair value in the absence of underlying market activity. This gap between 24/7 on-chain trading and intermittent traditional market hours creates a fundamental pricing problem that has historically limited DeFi’s ability to support reliable perpetual markets for traditional assets.

Kaiko’s regulated data solves this through regulated benchmark calculation methodologies that institutional risk committees can audit. As a regulated Benchmark Administrator under the EU BMR framework and compliant with IOSCO principles, Kaiko provides transparent, auditable rates derived from multiple venue data with clear attribution and licensing infrastructure. These are not proprietary black boxes or centralized oracle assumptions. They are trusted data solutions that empower exchanges, asset managers, and financial institutions with the reliability and transparency required for robust settlement and risk management in digital asset markets.

Markets maintains competitive depth during traditional trading hours and demonstrates a decisive advantage when those markets close, achieving the deepest orderbooks among HIP-3 venues during off-hours. While competitors see depth deteriorate by 29% during off-hours, Markets expands from $0.67M to $0.90M, a 34% increase that gives it the highest absolute depth. This counterintuitive pattern, where liquidity deepens rather than decreases, reflects the synergy between Kaiko’s continuous benchmark rates and Markets’ infrastructure.

Regulated price feeds form the critical missing piece for what some call the “perpification of everything” moving traditional assets into continuously traded perpetual markets. Without auditable data, these perpetuals remain niche products for crypto-native users willing to accept counterparty and data quality risks. With proper data infrastructure, however, the perpification thesis becomes viable at institutional scale.

Transparency

Markets introduces data transparency features previously unavailable for on-chain TradFi asset trading. Users can access on-chain liquidation heatmaps showing where leveraged positions cluster, similar to centralized exchange features but with verification guarantees. Stop loss heatmaps reveal defensive positioning across the market. Level 4 order book data provides depth visibility typically reserved for institutional market makers.

Verified trader data shows all participants’ entry prices, exit fills, pending orders, and realized P&L. This creates informational symmetry impossible in traditional markets where position data remains proprietary.

Tokenization Meets Perpetuals

The parallel trend of real-world asset tokenization creates complementary momentum. As traditional assets move on-chain through tokenization, the existence of robust perpetuals markets increases their utility. A tokenized equity becomes more liquid when traders can hedge exposure or take leveraged positions through perpetual markets.

However, tokenization without trading infrastructure creates stranded assets. Our previous research on RWA tokenization showed how even successfully tokenized products struggle with liquidity, often maintaining depth-to-volume ratios exceeding 100:1 during volatile periods. Markets demonstrates how proper data infrastructure transforms tokenized assets from proof-of-concept experiments into genuinely tradeable products.

Conclusion

The rapid growth of Markets.xyz demonstrates what becomes possible when institutional data infrastructure meets DeFi’s composability and transparency. Reaching $300M in volume in its first 10 days of trading, maintaining deep liquidity across assets, and introducing market transparency features all point to a fundamental shift in how global markets can operate.

The partnership between Kaiko and Kinetiq addresses data reliability, the core problem holding back DeFi’s competition with traditional finance. By enabling continuous trading of global assets outside traditional market hours and providing transparency features impossible in legacy markets, it represents genuine innovation. The first 10 days’ data suggests participants agree.

MORE FROM KAIKO

![]()

Perspectives

Paris

Data Infrastructure Powers the Next Generation of On-Chain Markets

Kaiko’s institutional-grade price feeds enabled Markets by Kinetiq to achieve the fastest growth trajectory among HIP-3 DEXs, processing $300M in the first 10 days.

24/01/2026

Read More![]()

Perspectives

Paris

Beyond the Buy: A New Model Emerges for DATs

Learn more about how digital asset treasury strategies are moving beyond passive accumulation.

16/01/2026

Read More![]()

Company

New York

New Change FX and Kaiko partner to deliver regulated Benchmark FX data on the Canton Network.

Kaiko, the global leader in institutional digital asset market data and infrastructure, and New Change FX (NCFX), the FCA-regulated global leader in independent FX benchmark rates, today announced a strategic collaboration to bring high-quality, re...

07/01/2026

Read More