Join us in Cannes for our Institutional Conference this Spring

Prediction Markets Face a Pricing Infrastructure Problem

Prediction markets shed the 2024 election gimmick label. They cleared billions in volume last year, solidifying their place as a real corner of the market. But as with any fast-growing sector, cracks are starting to show, none more obvious than in how crypto prediction markets are getting priced.

These markets, which behave a lot like binary options, have seen a flurry of activity in recent weeks, as well as some rumoured manipulation. This is a weakness that threatens to limit institutional adoption and regulatory acceptance: the lack of standardized, manipulation-resistant pricing benchmarks for crypto prediction markets.

As platforms like Polymarket expand into cryptocurrency price predictions, they face the same pricing challenges, as recent activity on XRP markets showed. Similarly the October 2025 flash crash demonstrated what happens when pricing infrastructure fails, single-venue dependencies, cross-platform dislocations, and forced liquidations from inaccurate valuations.

For prediction markets settling contracts worth millions, these pricing failures represent an existential risk.

The Single-Source Pricing Problem

Most crypto prediction markets currently rely on one of two pricing approaches, both of which create vulnerabilities.

Single exchange reference prices is the main resolution source. Markets settle based on a specific venue’s closing price, exposing users to manipulation risk and venue-specific technical failures. During the October crash, BTC prices varied by over $4,000 across major exchanges within minutes. A prediction market tied to Kraken’s price would have settled at $100,000, while the broader market consensus never fell below $104,000.

Platforms that do use data aggregators aren’t using regulated venues which regularly price these types of markets. Some platforms use multi-venue aggregation, but without transparent methodologies or independent oversight. These approaches lack audit trails, published calculation rules, or regulatory compliance frameworks, making them unsuitable for institutional participation or regulatory scrutiny.

The impact of these weaknesses compounds as prediction market volume scales. A 1% pricing error on a $1 million market could mean $10,000 in incorrect settlements. At Polymarket’s scale, processing billions in volume, even small pricing discrepancies create substantial issues and legal concerns.

Early Stress Events

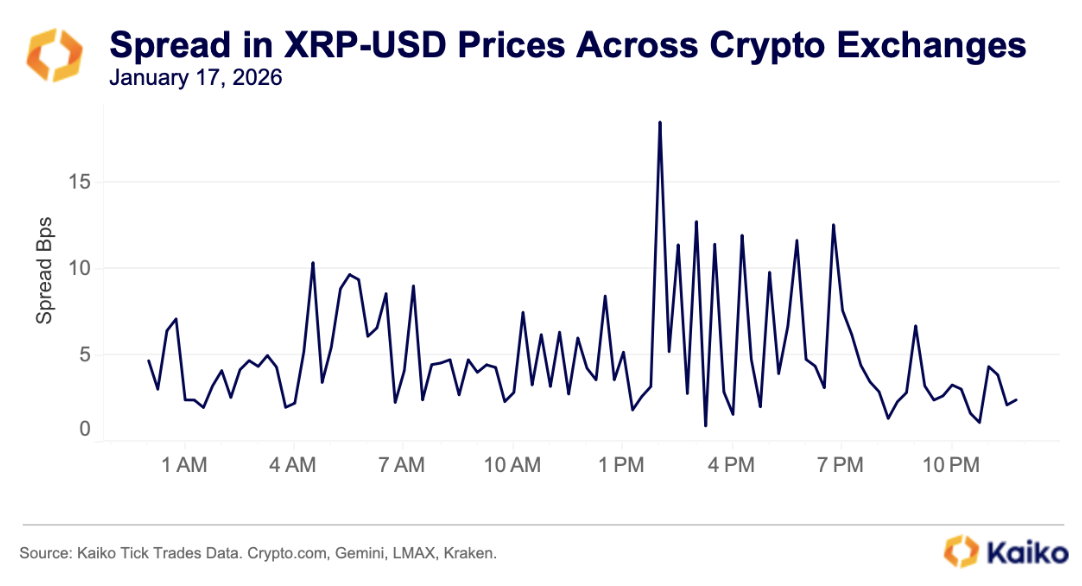

A recent incident on Polymarket exposed this vulnerability in stark terms. On January 17, 2026, a trader allegedly exploited thin weekend liquidity to manipulate 15-minute XRP price prediction markets, extracting $233,000 in profit at the expense of market-making bots and retail participants.

The mechanics were quite straightforward. The trader accumulated “UP” shares, pushing the implied probability to 70% despite XRP declining 0.3% from the open. The market-making bots interpreted this as mispricing, XRP was down, yet UP shares were trading at 70 cents.

Two minutes before settlement, a wallet on Binance executed a $1 million USDT market buy of XRP spot. This pushed XRP’s price up approximately 0.5% from pre-manipulation levels. The prediction market settled with XRP “UP” from the open, and the attacker’s 77,000 shares paid out at $1.

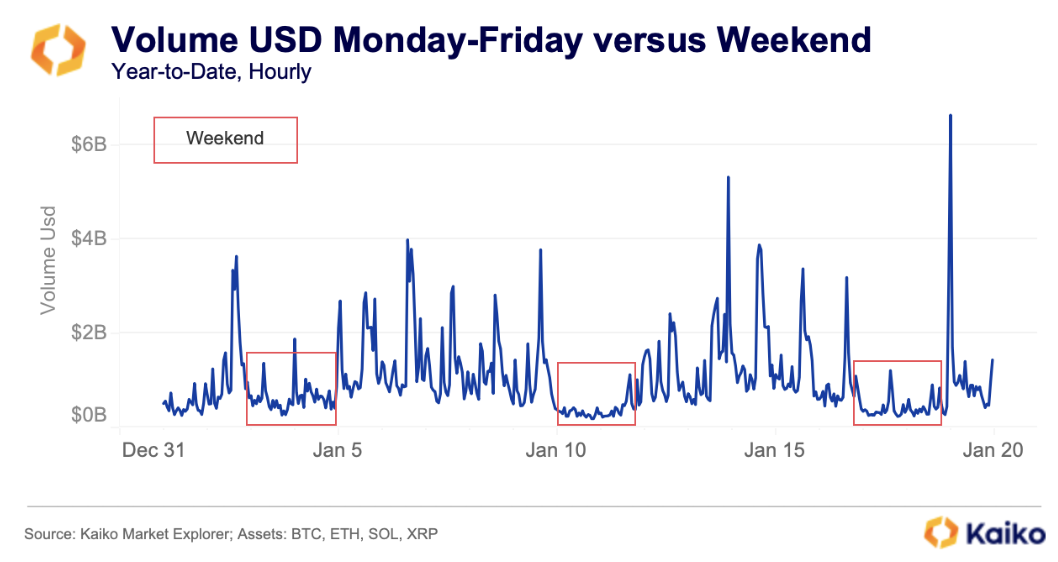

A crypto price prediction market settling on a single exchange’s closing price inherits that venue’s risks and liquidity constraints – which are particularly low on weekends as emphasised by market data for the leading four cryptocurrencies.

On weekends, this arbitrage activity diminishes alongside overall liquidity, allowing prices to drift apart significantly.

During weekday trading hours, cross-exchange price dispersion for major assets typically remains below 5 basis points as arbitrageurs and market makers actively close price gaps.If we observe XRP-USD tick trades on Crypto.com, Gemini, LMAX Digital, and Kraken, we see significant dispersion in prices. On January 17 the spread spiked to over 18 basis points at one stage. This dispersion pattern reflects the weekend liquidity deterioration noted above.

As volumes drop 50% and market depth falls, the cost for an attacker to create price dislocations on a single exchange decreases while the probability that this dislocation diverges from broader market consensus increases.

The Infrastructure Gap Between Prediction Markets and Derivatives

Traditional financial derivatives solved this exact problem through multi-venue benchmark indices. Cboe’s Bitcoin and Ether rates, for example, aggregates trade data from multiple exchanges using a transparent methodology developed with Kaiko. This audited methodology filters for outliers and manipulation.

It’s this type of approach that prevents the XRP-style attacks because manipulating the reference price would require coordinating manipulation across multiple venues simultaneously, raising costs exponentially. A $1 million manipulation attempt spread across 3-5 exchanges with varying order book depths becomes economically infeasible.

Crypto prediction markets need equivalent infrastructure, but face notable challenges:

- Rapid deployment: To remain relevant prediction markets need benchmarks in minutes, not months. This has led some venues to price equity price markets off of Yahoo finance, something there’s millions relying on this for settlement. Similarly, the XRP market existed because there was demand, but without proper pricing infrastructure, it became a manipulation target. Instant access to robust prices via regulated rates fixes this.

- Comprehensive coverage: Platforms need benchmarks for altcoins and emerging tokens, not just BTC and ETH. Limited coverage forces a choice between missing out trending markets or accepting exploitable single-venue pricing.

- Real-time manipulation filters: 15-minute settlements require sub-second updates with built-in outlier protection. Traditional benchmark cycles, daily or hourly, don’t work for short-duration markets.Regulatory credibility: As institutional capital enters prediction markets, regulated benchmark administrators provide immediate compliance credibility.

Why Kaiko’s Reference Rates Address This Gap

Our reference rates were built specifically to provide institutional-grade crypto benchmarks that meet regulatory standards while maintaining the flexibility prediction markets require.

As the only independent, regulated benchmark administrator for digital assets, Kaiko provides governance frameworks, transparent methodologies, and audit trails that satisfy institutional and regulatory requirements. This regulatory status differentiates Kaiko from unregulated data aggregators and single-exchange prices.

Our technical infrastructure aggregates data from 100+ exchanges representing over 99% of traded crypto markets. This comprehensive approach eliminates single-venue risk, during the October crash our BTC-USD Reference Rate never fell below $104,000 despite individual exchanges trading as low as $100,000.

For XRP, Kaiko Indices rates, currently, use data from Crypto.com, Gemini, Kraken, LMAX, and Bitstamp. Manipulating this benchmark would require coordinating market orders across all constituent exchanges simultaneously, raising costs and exposing the manipulator to KYC requirements.

Deployment speed matches prediction market requirements. New Reference Rates can be developed and launched within short timeframes, enabling platforms to capitalize on trending narratives while maintaining pricing integrity. The commercial framework allows platforms to access new benchmarks without renegotiating contracts, removing friction as market offerings scale.

The methodology includes built-in protections against outlier trades and manipulation attempts. Volume-weighted calculations with outlier filters ensure that single large orders cannot disproportionately influence reference prices. For 15-minute settlement windows, Kaiko can publish time-weighted average prices (TWAP) over the settlement period rather than single timestamp snapshots further reducing manipulation vulnerability.

What This Means for Polymarket

Polymarket sits at an inflection point. The platform has established market leadership in prediction markets broadly, but expanding aggressively into crypto predictions without addressing pricing infrastructure creates unnecessary risk.

Competitors willing to invest in regulated, manipulation-resistant pricing infrastructure will have a defensible advantage as institutional capital enters prediction markets and regulatory frameworks develop. The infrastructure choice made today determines which platforms can scale to serve institutional users and which remain constrained to retail-only markets.

Gemini faced this exact decision when launching Gemini Predictions in the U.S. As a regulated entity, they required a regulated crypto benchmark administrator with rapid deployment capabilities and comprehensive asset coverage. They use our reference rates specifically because unregulated alternatives didn’t meet their compliance and operational requirements.

The question for Polymarket is pretty straightforward, as prediction markets for cryptocurrencies (and equities, bonds, and commodities) scale from millions to billions in volume, will pricing infrastructure keep pace, or become the limiting factor?

Want the full analysis?

Subscribe to Kaiko Research Premium for more market insights.

MORE FROM KAIKO

![]()

Perspectives

Paris

Davos, Macro Drivers & Crypto Implications

As prediction markets scale to billions in volume, pricing infrastructure must evolve beyond single-venue dependencies, or systematic manipulation will remain a risk.

28/01/2026

Read More![]()

Perspectives

Paris

Prediction Markets Face a Pricing Infrastructure Problem

As prediction markets scale to billions in volume, pricing infrastructure must evolve beyond single-venue dependencies, or systematic manipulation will remain a risk.

27/01/2026

Read More![]()

Perspectives

Paris

Data Infrastructure Powers the Next Generation of On-Chain Markets

Kaiko’s institutional-grade price feeds enabled Markets by Kinetiq to achieve the fastest growth trajectory among HIP-3 DEXs, processing $300M in the first 10 days.

24/01/2026

Read More