Join us in Cannes for our Institutional Conference this Spring

How Recap.io Leverages Kaiko’s Fair Market Value Pricing Solution

Kaiko Products for Crypto Valuation Compliance

Solutions designed with IFRS, GAAP and FASB compliance in mind.

Join us in Cannes for our Institutional Conference this Spring

Determining a fair market value (FMV) for crypto assets for tax and accounting purposes is fraught with complexities due to issues like market fragmentation, volatility, discrepancies in exchange rates across different platforms, and 24/7 markets.

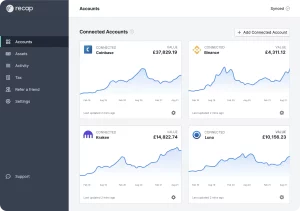

Recap encountered significant challenges in sourcing an appropriate pricing service for their tax and accounting software. They needed a solution that could not only provide accurate FMV for their clients but also align with prevailing compliance standards.

In collaboration with Recap, Kaiko engineered a sophisticated pricing service ensuring a reliable Fair Market Value (FMV) for all crypto assets, dynamically adjusting to volatile market conditions and compliant under existing accounting standards.

Crypto markets are marked by heavy-tailed distributions in prices and volumes, filled with outliers, which poses significant challenges for aggregation, particularly for conventional approaches like Volume Weighted Average Price (VWAP) and Volume Weighted Median (VWM).

To address this, Kaiko’s innovative crypto Fair Market Value Pricing solution leverages a robust weighted median methodology and is designed to provide precise, agile, and equitable valuation of crypto assets in compliance with IFRS and FAAP accounting standards.

Dan Howitt, Co-Founder Recap.io

“Kaiko greatly enhances our offering with robust crypto valuations that accurately mirror market liquidity. Their service offers thorough audits and in-depth traces, clearly explaining the processes used to derive these valuations.”

Recap developed a tool that enables their clients to look up any crypto asset and return the FMV for this asset and audit trail that determined the price. This data-focused approach, powered by the robustness of Kaiko data and augmented by additional sources, currently powers FMVs for US and South African customers in the Recap platform.

We serve 200+ enterprise clients worldwide, from financial institutions to crypto-native enterprises. Learn how you can benefit from Kaiko today.