Join us in Cannes for our Institutional Conference this Spring

Welcome to the index in focus!

Welcome to the Index in Focus! This week, we’re diving back into a popular topic: Bitcoin and gold. Old versus new, digital versus analog. However, the narrative may be shifting based on recent trends and proven products.

-

Increased demand for exposure to both assets

-

Bitcoin’s outperformance and gold’s stability

-

Volatility diversification through dynamic weighting

Bitcoin & Gold, Complimenting or Competing?

This week, we’re diving back into the Bitcoin and Gold debate and examining the increasing demand for combined exposure to both assets. As both assets have rallied over the past few months, asset managers in the U.S. and beyond have increasingly sought to build products that capture these dual gains.

Kaiko Indices’ own custom product, the BOLD Index, already offers exposure to both assets and serves as a proof of concept for issuers entering the space. When we last looked at the BOLD Index in March, Bitcoin was underperforming under the weight of U.S. tariff policy, while Gold continued its impressive performance of the past few years.

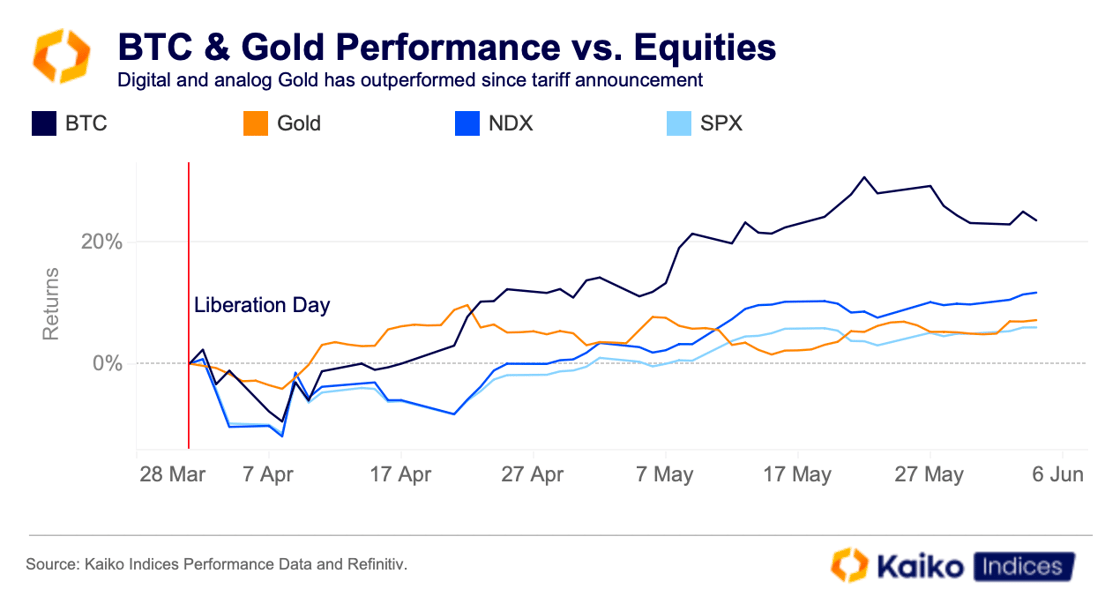

That trend has changed significantly since April and the Liberation Day tariff announcement. In this report, we’ll explore the evolution of the two assets’ performance, the benefits of combined exposure, and the role that Bitcoin’s maturing volatility profile plays.

Demand for Digital and Analog Gold

Bitcoin broke new ground above $112k last month, while gold continues to trade near all-time highs around $3k. Both assets share fundamental monetary properties, particularly when it comes to scarcity—gold’s physical limitations and Bitcoin’s capped supply of 21 million.

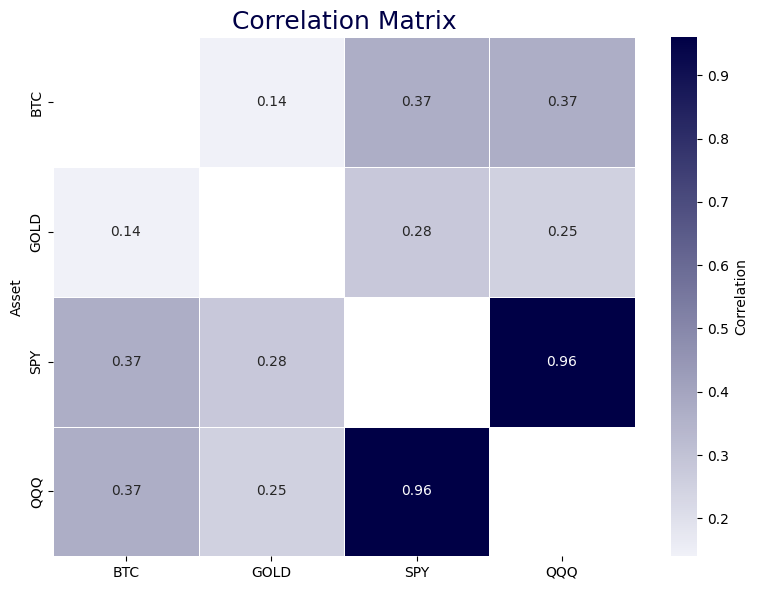

Recent months have highlighted how political uncertainty can drive demand for alternative assets. Despite Bitcoin’s status as a safe haven being hotly debated, it has demonstrated value as a diversifier recently, during periods of tariff-driven volatility. Its returns have been uncorrelated with both equities and Gold. In fact, over the past year, the 30-day rolling correlation between Bitcoin and Gold has ranged from -0.48 to 0.67, staying negative for extended stretches.

Bitcoin has outperformed all major assets since the U.S. government’s April 1 tariff announcement, while gold has outpaced the S&P 500, showcasing the value of balanced exposure to both assets.

This outperformance appears to be directly influencing product ideation in various regions. In particular, several firms in the U.S. have filed to launch funds offering exposure to both assets. Return Staked is offering a BTC and gold ETF with exposure to equities as well, while Cantor Fitzgerald revealed plans last week for a gold-protected Bitcoin fund.

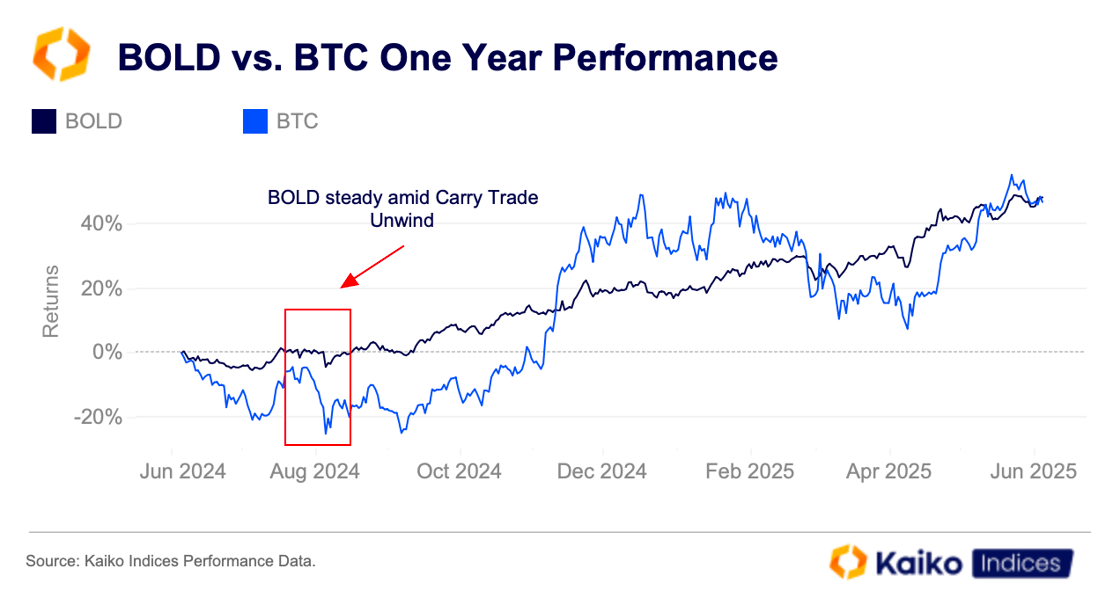

Cantor’s plans to launch a fund with protection based on gold exposure echo work already done by Kaiko Indices—namely, the BOLD index, which powers 21Shares and Bytetree’s European-based exchange-traded product of the same name. The BOLD ETP boasts over $20 million in assets under management and has outperformed Bitcoin since last June.

The structural similarities between Bitcoin and gold, combined with both assets’ potential to hedge against currency debasement, provided the thesis for the BOLD index. At the same time, the assets’ unique responses to market events reinforce the benefits of combined exposure.

Bitcoin has outperformed over longer periods and has begun to show safe-haven qualities. However, it still tends to behave like a risky asset during market turmoil, as we saw during the Japanese carry trade unwind last August. Bitcoin plunged around 20% during this period, while gold remained steady.

As such, BOLD’s rise comes with less volatility, which is mostly due to its weighting approach. The index’s dynamic weighting method offsets some of Bitcoin’s volatility, while still allowing for participation in the asset’s upside.

BOLD and the Inverse Volatility Advantage

Traditionally, index construction relies on market capitalization or equal weighting. The market cap trap has been shown to create inefficiencies in asset selection within crypto, and often ignores the fundamental relationship between risk and return.

The BOLD Index uses inverse volatility weighting, a risk parity methodology that allocates capital in proportion to the inverse of each asset’s volatility. This approach ensures that both Bitcoin and gold contribute equally to portfolio risk, regardless of their individual volatility profiles, which are quite different.

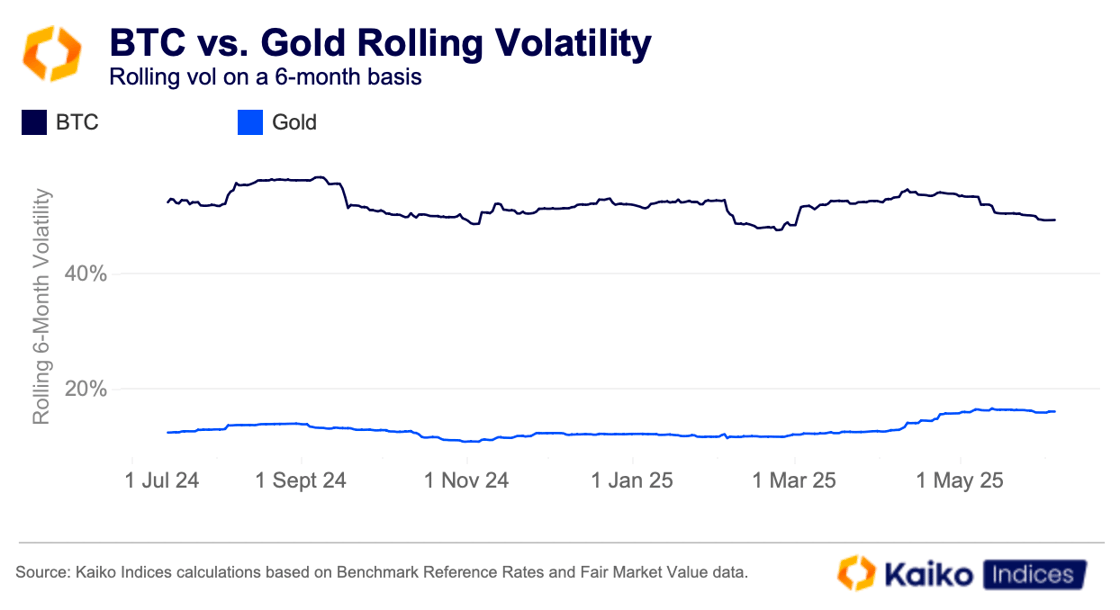

Bitcoin’s volatility profile is changing, but it remains elevated (around 50%) compared to other asset classes, which can act as a deterrent for new investors. Meanwhile, gold’s volatility is consistently below 20%. As we enter a period where the two assets appear to be complementing one another rather than competing, these differences can be harnessed to create a form of “volatility diversification.”

So how does the weighting work? The math is quite straightforward, yet efficient. If Bitcoin exhibits 50% annualized volatility while gold maintains around 16%, the inverse volatility approach allocates three times more weight to gold than a basic equal-weight strategy.

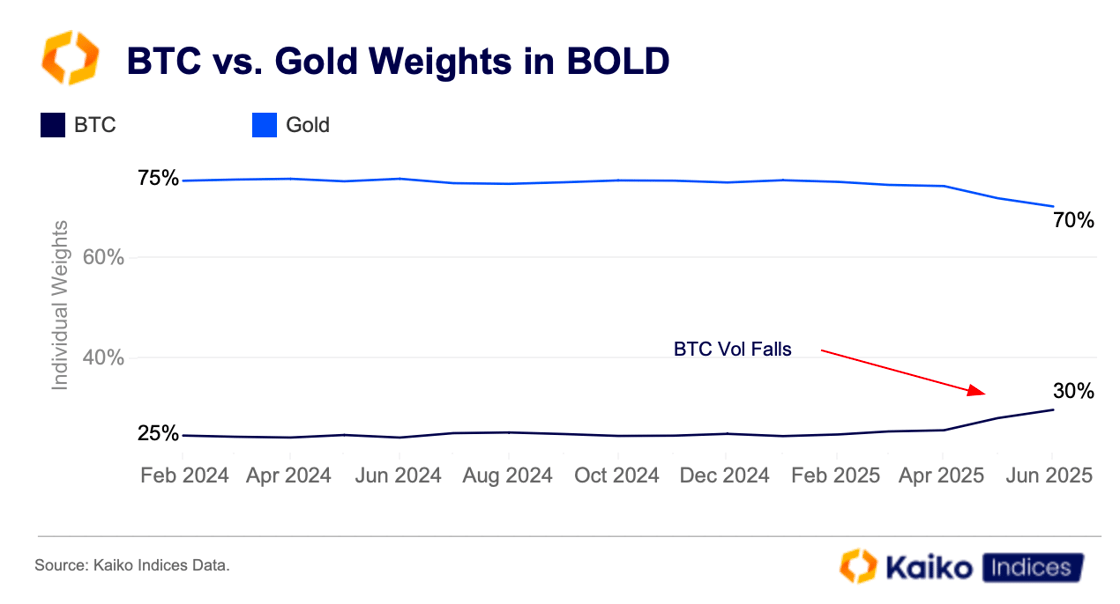

This dynamic rebalancing mechanism automatically increases exposure to Bitcoin during calmer phases or as the market matures and its volatility falls.

This dynamic rebalancing mechanism automatically reduces exposure to Bitcoin during volatile periods while increasing allocation during calmer phases, providing a systematic approach to buying low and selling high.

Another benefit of this approach is the varying correlation between Bitcoin and gold over time, as noted above. The uncorrelated returns create natural diversification benefits, which are further amplified by inverse volatility weighting through systematic risk budgeting.

What Lies Ahead

As institutional adoption accelerates and market infrastructure matures, the case for combined Bitcoin and gold exposure will likely continue to strengthen. The latter half of 2025 has the potential to reinforce this narrative further, which likely explains the recent U.S. filings and fund announcements.

Central banks’ demand for gold is unrelenting, while countries and corporations around the world are piling into BTC, using the asset as a strategic reserve. With these factors in mind, the BOLD Index’s performance offers a unique way to quantify this demand in market terms.

More from Kaiko Indices

FEX Global x Kaiko Indices Podcast

- FEX Global’s podcast with Adam Morgan McCarthy spotlights how firms like Kaiko bridge traditional finance and digital assets, emphasizing the value of regulation.

- Our latest crypto spot exchange ranking is out now, evaluating exchanges based on six criteria: governance, technology, business, liquidity, security, and data quality.