Join us in Cannes for our Institutional Conference this Spring

Welcome to the index in focus!

Welcome to the Index in Focus! Forget BTC’s new record, how do perp contract specs impact volume? That’s what we’re looking at this week. In particular we focus on how quote assets and settlement impact trade volumes.

-

Anatomy of a perps contract

-

Quotes and settlement

-

Impact of contract specs on volume

How Perp Contract Specs Impact Volume

Last month we covered the key features on the perpetual futures market in crypto, how it sizes up compared to spot markets, as well as the unique drivers of returns and price action.

We didn’t cover contract specifications then as this topic deserves its own report. There is a lack of standardization across venues when it comes to contract specifications. Each exchange offering perps contracts uses their own contract design, which can create challenges for market participants. We’ll explore how this can impact trading strategies, risk management, and operational complexity in today’s report.

Perpetual Futures Contract Specs

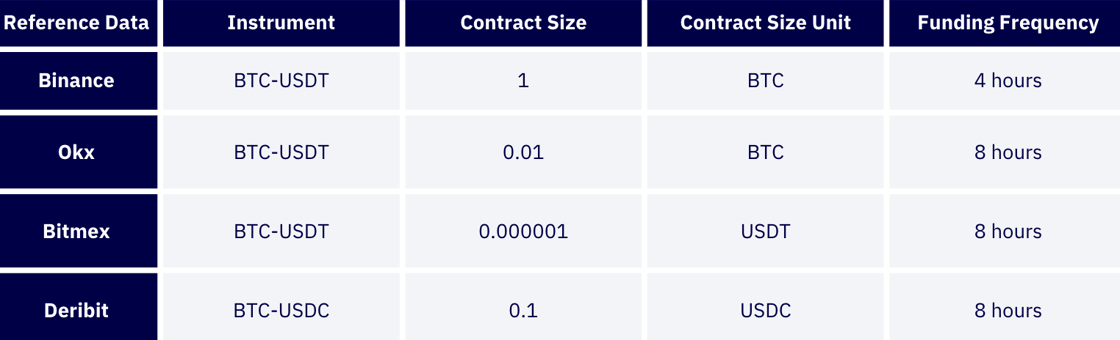

In the below table we see how contract specs vary from one exchange to another. The starkest difference is contract sizing. Binance uses a standard 1 BTC contract size, while Bitmex contracts are quoted in USDT at a size of 0.000001.

These differences create additional complexity for traders and market makers, particularly around position sizing and risk management. For instance, trading across these two venues means considering depeg risks as well as idiosyncratic risks tied to BTC, funding rate windows, and liquidity constraints.

While certain specifications vary from venue to venue, and even asset to asset, there is one dominant theme across most perps contracts, USDT.

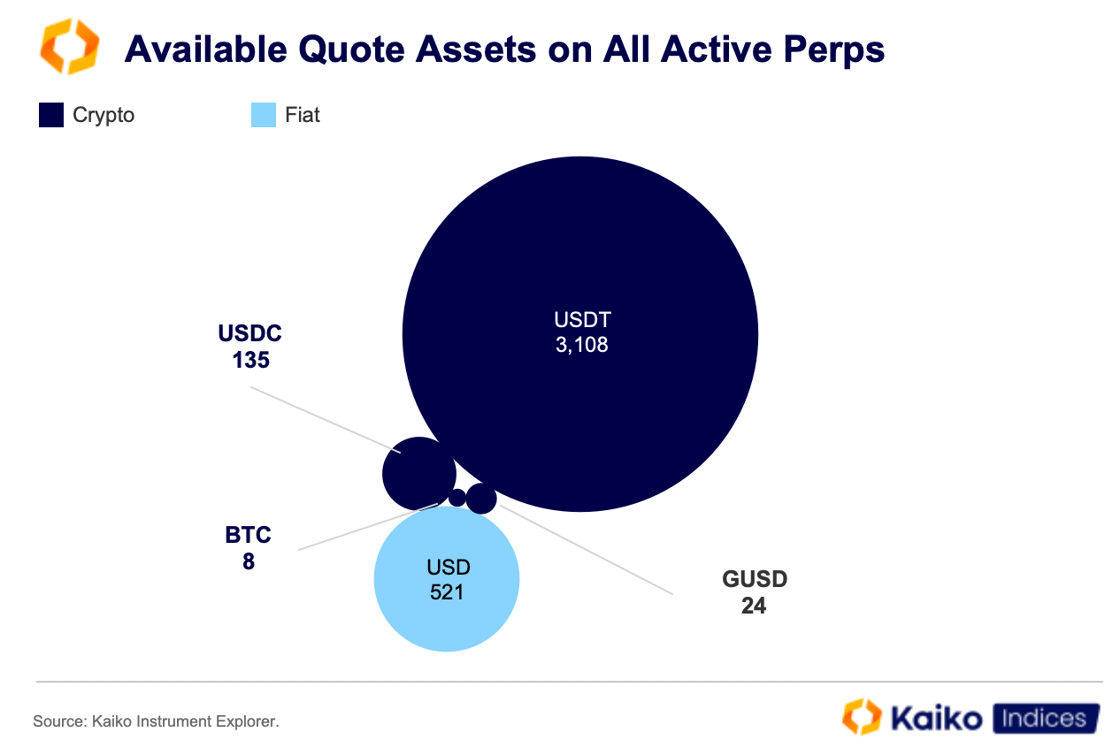

Tether’s stablecoin is the most popular quote asset for perps contracts. There are over 3,100 instruments quoted in USDT, according to Kaiko reference data. This dwarfs the next largest stablecoin by market cap, USDC, which is quoted against only 135 different assets.

The above example uses most commonly traded of these contracts, linear perps. These can be referred to as USDT-margined depending on the venue, but typically mean the contract is settled in the quote asset. Inverse perps are settled in the base, but the market for BTC-margined perps is a lot smaller than the linear alternative.

Inverse perps account for less than 30% of total market share for BTC and ETH perps trading volume. The main benefit of crypto-margined perps is not having to sell the underlying to fund trades.

BTC is an even smaller share of the market, showing the relative lack of appetite among market participants for coin-margined contracts. This makes sense in the context of trading in crypto markets as USDT and other stablecoins are more popular trading vehicles. These allow traders to move in and out of positions without taking on additional price risk, whereas trading coin-margined contracts exposes them to the underlying settlement assets own risk.

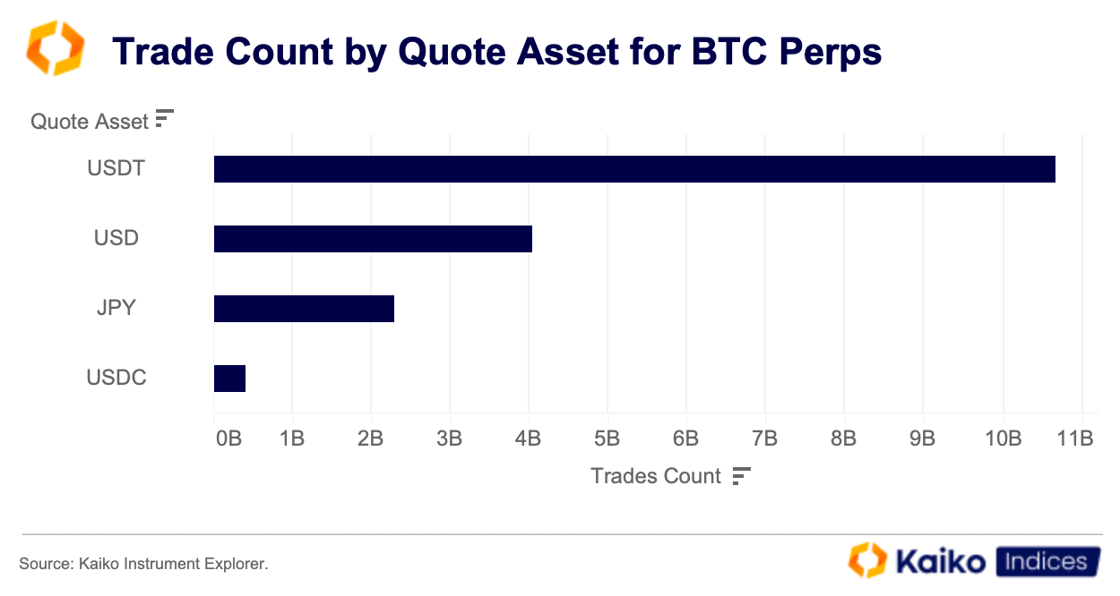

Its not just popularity in terms of quote assets and contract specifications though, this dominance directly translates into the market. USDT leads by trade count for BTC perps for instance, with nearly 11 billion trades on USDT quoted BTC perps alone.

Interestingly the next most popular quote assets for BTC perps are both fiat currencies, the U.S. Dollar and the Japanese Yen. This makes sense for USD as it has more active pairs than USDC or other exchange-specific stables like Gemini’s GUSD. Meanwhile, the JPY popularity is driven by historical exchange volume, notably BitFlyer which has had BTC perps since 2015.

Recent trends in settlement and exchange integrations will likely upend this list though, as USDC has already begun to grow its share on some key venues.

How specs impact volumes

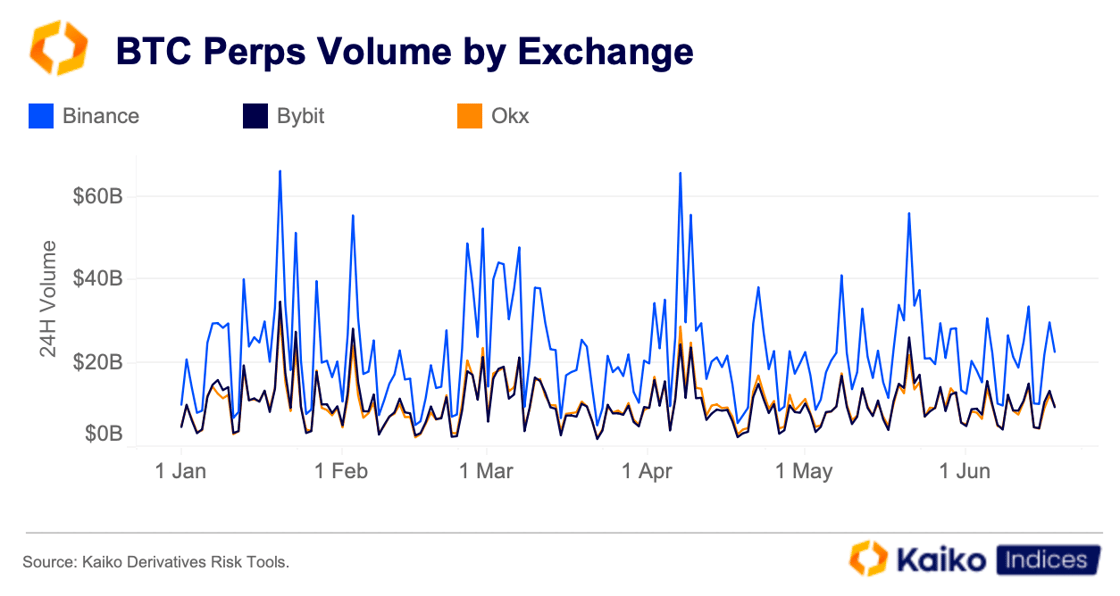

While volume and trading activity is driven by similar players to the spot market, there is still a decent amount of liquidity fragmentation. Binance, Bybit, and Okx lead the way in terms of trade volume, with Binance holding the crown of highest volume and open interest. Although Bitmex pioneered the use of perps products in crypto nearly a decade ago they account for only a small percentage of market.

Combined BTC volume across the big 3 venues regularly exceeds $100bn. Binance is by far the largest venue, with volumes as high $60bn at several points this year.

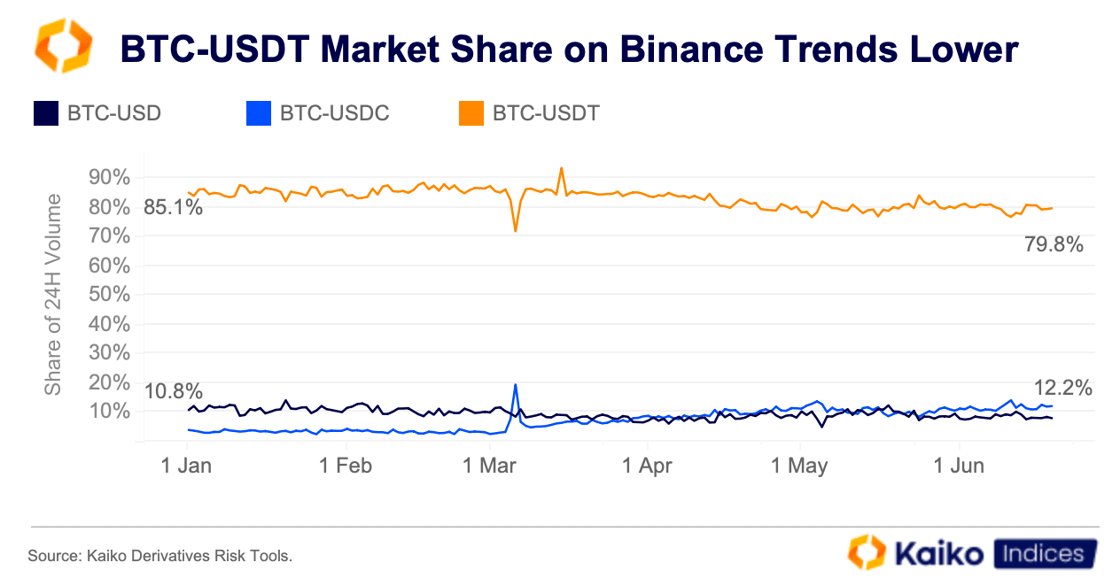

One interesting trend observed on Binance this year has been the decrease in USDT quoted instruments dominance relative to USDC and USD. Circle’s USDC has seen its market share increase by nearly 2 percentage points since the beginning of the year, briefly spiking in March.

This spike and subsequent climb in USDC perps volume since was likely driven by a combination of regulatory events spotlighting stablecoins and Binance’s launch of new USDC-margined contracts. With the continued importance of stablecoins onshore in the US, and as progress continues on the GENIUS act demand for USDC quoted and settled products should continue to rise.

Conclusion

USDT’s hold over the perps market isn’t a coincidence. Traders and other market participants are happier to use it due to its history, liquidity, and interoperability. It’s capital efficient.

When managing risk across multiple positions and venues adding an additional layer of complexity through less liquid stablecoins or even coin-margined products is not ideal. For example, a coin-margined product means the volatility of collateral currency must be taken into account.

However, some aspects of the market still get overlooked. Seemingly minor contract specifications have actually shaped liquidity ecosystems. Legacy decisions have often dictated volumes and flows, creating a path dependency of sorts.

As more traditional institutions enter the market they will look deeper into these products, beyond leverage and funding rates. These firms, and their extensive risk teams, will parse through the specs laid out here (and more), to understand how settlement mechanics impact their strategies, and position accordingly.

As crypto markets continue matures, the venues that get these fundamentals right will capture the lions’ share of activity. For traders and institutions, understanding these nuances isn’t just helpful, it’s essential.