Join us in Cannes for our Institutional Conference this Spring

Welcome to the index in focus!

Welcome to the Index in Focus! The KT10, Kaiko Indices flagship benchmark capturing the top 10 most liquid cryptocurrencies, rebalanced following a turbulent second quarter in markets, setting off fresh shifts among the top digital assets. BTC set a new high, while XRP and ETH have started to steal the spotlight. In this week’s report, we dive into the latest movers among the top cryptocurrencies, the impact of capped weightings in a top 10 strategy, and the forces driving risk across the leading crypto landscape.

-

Standout performers

-

Benefits of capped weightings

-

Tailwinds and risks for the leading 10 crypto assets

KT10 Outpaces as Altcoins Surge

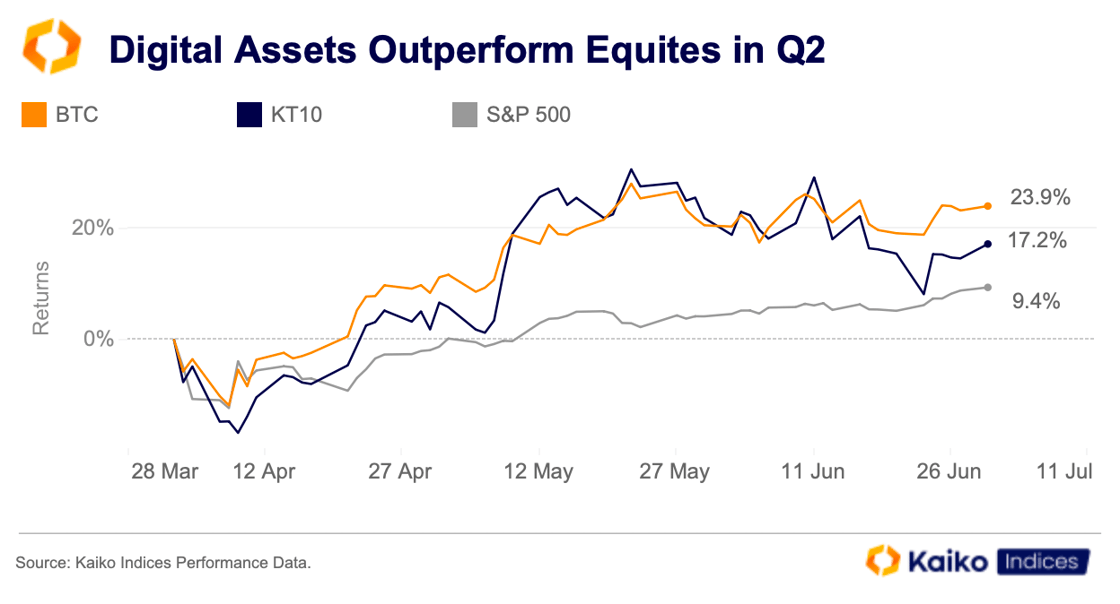

The second quarter saw BTC and digital assets reverse course after a rocky start, breaking their strong correlation with equities driven by U.S. tariff turmoil. That correlation fell at the beginning of the second quarter as BTC drove the divergence between digital assets and traditional markets.

While prices fell across markets following the liberation day tariff announcement, BTC bounced back strongly. While the tariffs proved to be a lame duck, with more delays than implementations in the first few months, asset prices rose across the board. The S&P 500 recovered its tariff-related losses, but didn’t keep pace with digital assets.

Later in the quarter the KT10 – Kaiko’s benchmark capturing the top 10 most liquid cryptocurrencies – even began to outperform BTC, while massively outpacing equity returns. BTC ended the second quarter up around 24%, while the KT10 returned an impressive 17.2%, nearly double that of the world’s most widely traded equity index.

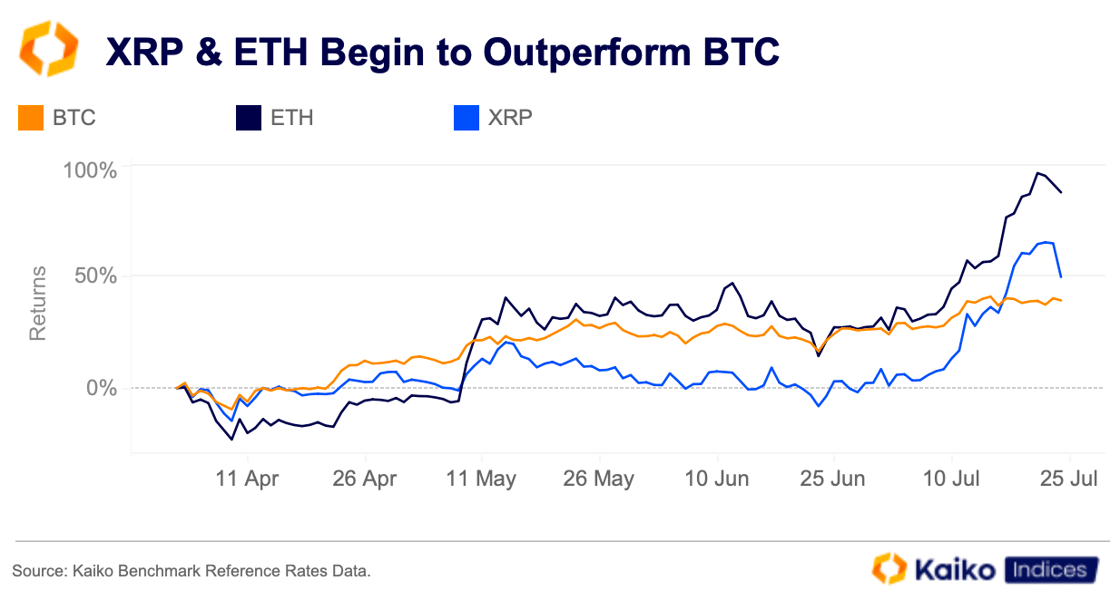

The momentum has continued into the third quarter for digital assets, but this time with more breadth. The KT10 is up 35% over the past 30 days, while BTC gained 12%. XRP set a new record high for the first time in seven years, trading above $3.65 in July, while ETH has finally built some momentum, up over 88% since April 1.

The outperformance of altcoins relative to BTC has kicked off speculation of a potential “altcoin season.” While history doesn’t repeat itself and past cycles can’t be relied upon as maps to navigate live markets, liquidity data in spot and futures markets seems to support the notion.

With significant demand from institutions for assets like XRP and SOL, and impressive returns, the possibility is there for a drawn-out rotation into altcoins. For capped indices like the KT10, this could be their moment to shine.

New Kids on the Block

The KT10 operates a capped weighting system, with no single asset allowed to exceed 30% of the index. Following the Q2 rebalance, both BTC and ETH were capped at this level. Elsewhere, one asset left the index: the memecoin SHIB, while Stellar Lumens’ XLM entering.

The biggest change following the rebalance was XRP’s weight climbing to over 21%, up from just under 18% following April’s rebalance (when it flipped SOL).

The biggest change following the rebalance was XRP’s weight climbing to over 21%, up from just under 18% following April’s rebalance (when it flipped SOL).

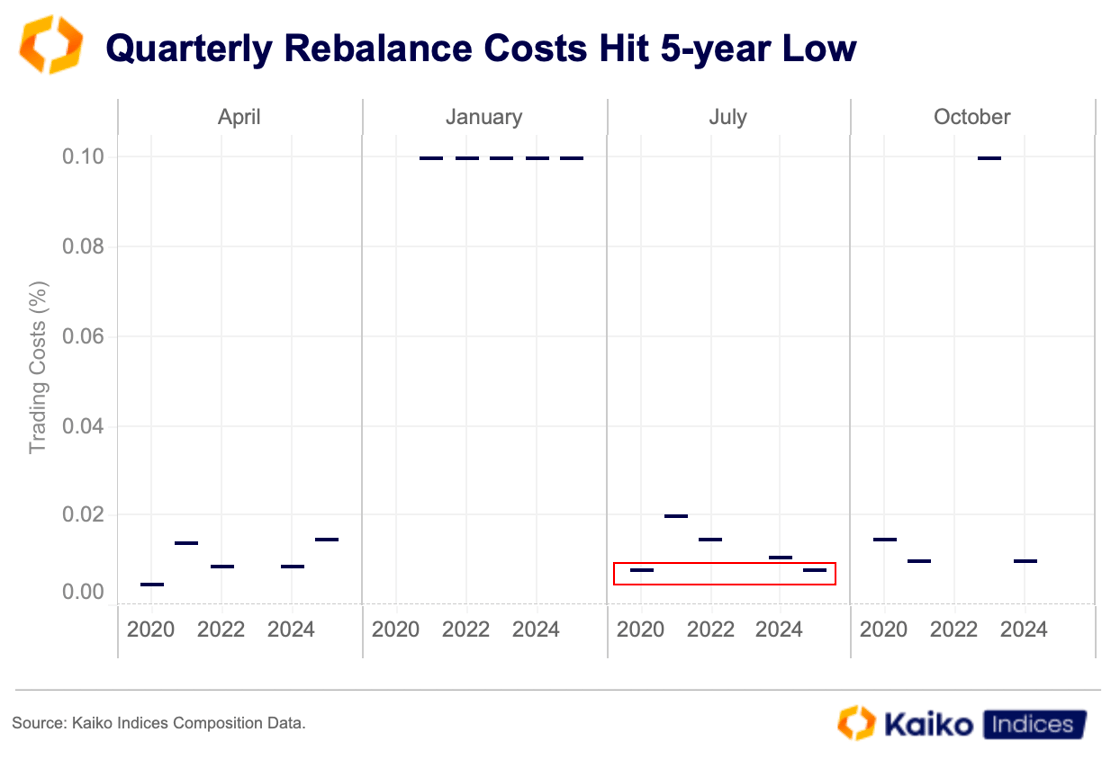

Relatively low turnover drove implied trading costs to a 5-year low. We estimate these costs at each rebalance by multiplying portfolio turnover by 0.10%, approximating the cost of buying and selling during rebalancing.

Drilling Down into Weighting

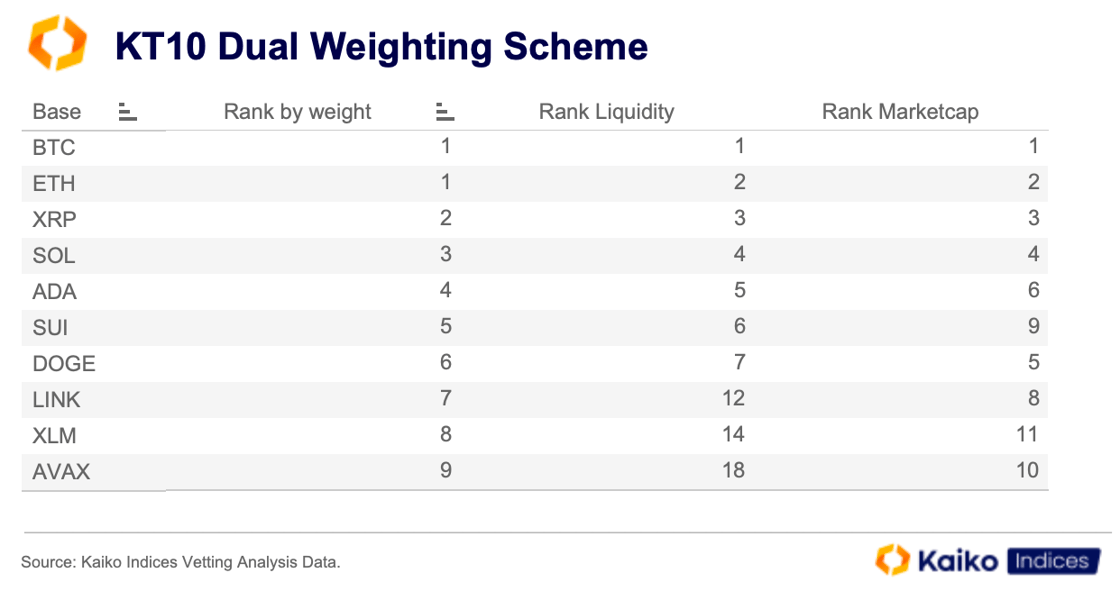

Looking beyond the basic constituent changes, we can also see other benefits in the KT10’s construction. The constituents are chosen based on a rigorous vetting process that ranks assets in terms of liquidity and market cap, with a 50% weighting in each case.

The dual-weighting approach, blends market cap and liquidity data to make the index both representative and actually tradable. For instance, DOGE is ranked fifth by market cap, but seventh in terms of liquidity, with its final weighted rank sixth.

Market cap reflects each asset’s size, while liquidity ensures tradability. This approach captures market structure through cap weighting and filters for assets with sufficient trading activity to support institutional execution without significant market impact.

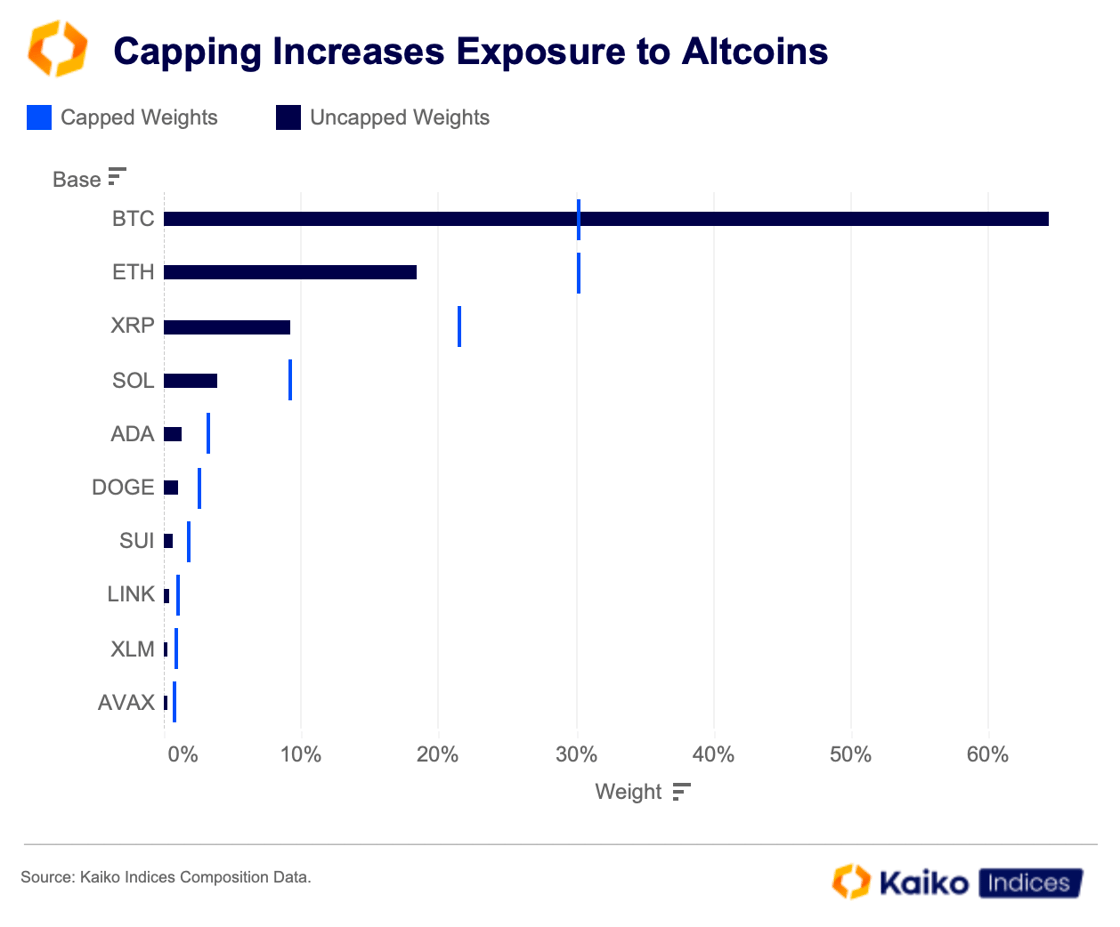

Additionally, the index constituents’ weights are capped to 30%. This avoids having a broad market index with 70% exposure to BTC. While the market is tilted towards BTC right now, its dominance has been falling and uncapped indices like this then fall short of capturing broad market returns.

Following the Q2 rebalance and capping implementation, BTC’s weight was more than halved from 64% to 30%. This resulted in ETH rising from 18% to 30%. XRP more than doubled its weight from what would have been 9% in an uncapped index, to over 21%.

In light of recent price moves and the strong potential for a sustained rotation into liquid altcoins, the capping factor allows the KT10 to more closely track the state of the market.

Risk outlook

Another interesting emerging trend in digital assets mirrors something commonly seen in equities. Typically, equity returns tend to have an inverse relationship with volatility, or in other words, negative returns = higher volatility. In crypto only a third of coins behave like this, with others showing the reverse or no relationship. This adds additional complexity for institutional firms adopting crypto assets, as their traditional hedging models must then be asset specific.

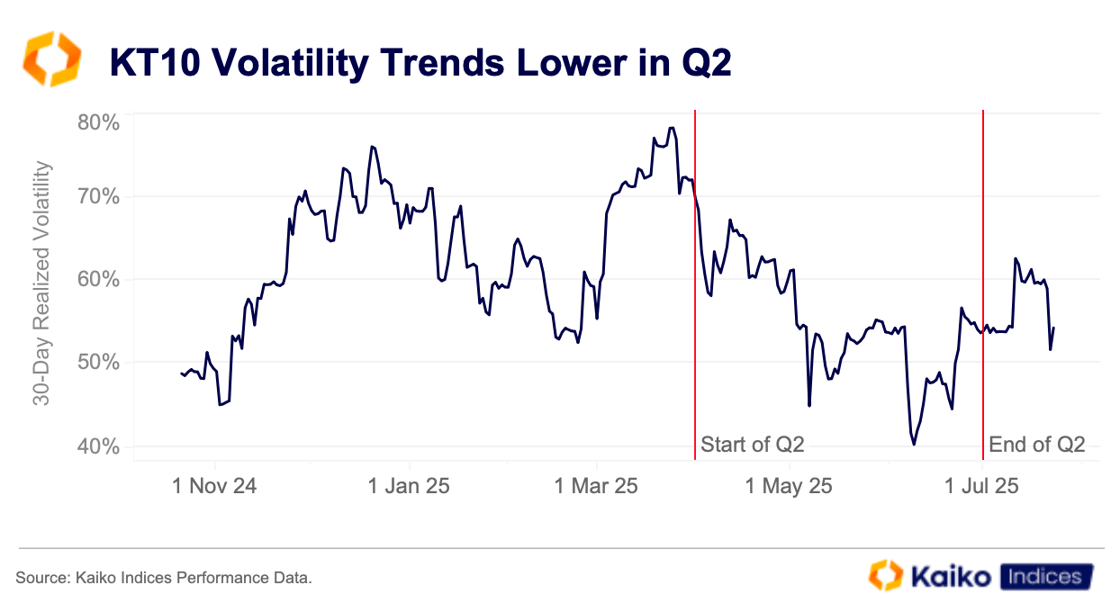

Over the past quarter the KT10’s constituents began to buck this trend. The overall index’s 30-day realized volatility fell from highs near 80% at the end of March, to near 40% by June, and currently around 50%.

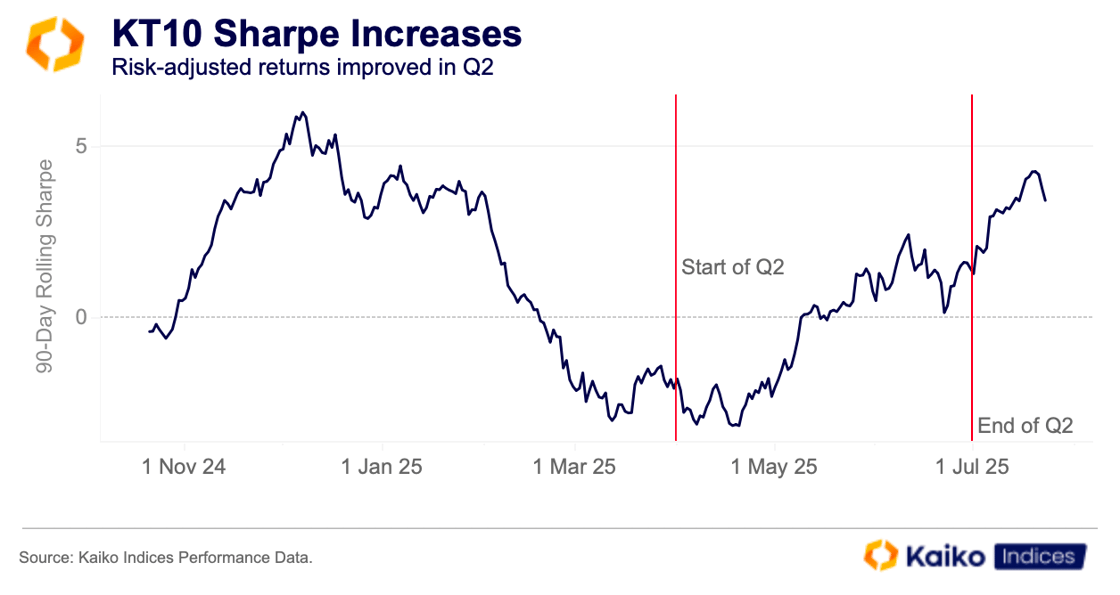

During this time, several assets rose to near all-time highs, while XRP set a new record high in July with realized volatility well below Q1 levels. On a risk-adjusted returns basis, the second quarter was encouraging. The KT10’s Sharpe ratio rose to 1.3 by the end of the quarter, climbing to over 3 by mid-July.

If this trend can hold, it should benefit institutional adoption further. If leading digital assets can behave like equities when it comes to volatility, while still outperforming on returns, then more firms will undoubtedly onboard into the space. Particularly as regulation improves and more traditional wrappers such as exchange-traded funds become available.

However, the market is not without its risks at present, and some are growing. Tariff negotiations with China will persist, despite concessions last week, and the interest rate debate rages on. The former poses possibly the biggest threat to markets in the short-run. The Fed is under pressure to cut, but Chair Powell gave no indication of a September cut this week when the FOMC kept rates unchanged. The probability that the rate remains unchanged in September is currently 60.8%, and the market is even pricing in a 38.7% chance that nothing changes in October.

Screenshot 2025-07-31 at 13.22.53

Increasingly the data is not supporting the decision to keep rates unchanged, and now the pressure to cut is growing from within. Two Trump appointees voted to cut this week, breaking ranks from the FOMC. This is the first time in 30 years two members of the committee dissented. These combined factors could lead to uncertainty and an uptick in volatility next month, during a low liquidity period in the market.

It’s also important to note that August and September are historically poor months for digital assets, as well as the broader market.

Conclusion

While the growing pressure within the FOMC and from the U.S. administration could drive the narrative in the coming weeks, there are plenty of tailwinds to contend with too. Right now the KT10 is outperforming BTC, showcasing the breadth in the market. While there might be potential for volatility in the short-run, liquid altcoins have some key drivers on the horizon.

The SEC is actively working with issuers on key topics, after recently approving in-kind create/redeems for BTC and ETH ETFs. Meanwhile, issuers and exchanges are pushing to implement token-listing standards that would create a straightforward path to listing crypto-related ETFs. With over 40 live crypto-related ETF filings sitting with the SEC, this should do well to encourage broader rotation as more altcoins receive the ETF treatment.

This environment, in the medium to long term, lends credence to a potential rotation or altcoin season.