Join us in Cannes for our Institutional Conference this Spring

Welcome to the index in focus!

Welcome to the Index in Focus! With perpetual futures markets set to take the U.S. by storm, we’re looking at the market for these unique contracts, how big it is, how pricing is managed, and what idiosyncratic features to track.

-

Offshore perps market size

-

Unique contract features

-

Regulatory risk and importance of accurate pricing

Perps are Coming to America

Derivatives dominate trading activity in crypto markets, and have done for the majority of the past decade. A major driver of this is perpetual futures contracts, these are futures contracts with no expiration date, trading in perpetuity.

Perps will be widely available to U.S. traders soon, as Coinbase announced plans to launch perps contracts for customers last week. Further bolstering the move, CFTC Acting Commissioner Caroline Pham said recently that “the CFTC must take a forward‑looking approach to shifts in market structure… one evolving trend is the move to 24/7, 24/6, or 24/5 trading hours,” adding that perpetual futures are already being evaluated and “we’re seeing some applications” that could go live shortly.

In this report, we will size and scope the global perps markets and examine the opportunities and risks associated with these products as they become available to U.S. traders. This includes evaluating the risks of using non-independent and non-regulated benchmark rates for the listing and settlement of these products. This setup echoes the conditions behind the LIBOR scandal, which led to billions in fines, criminal prosecutions, and sweeping benchmark reforms.

What is the size of the BTC perps market?

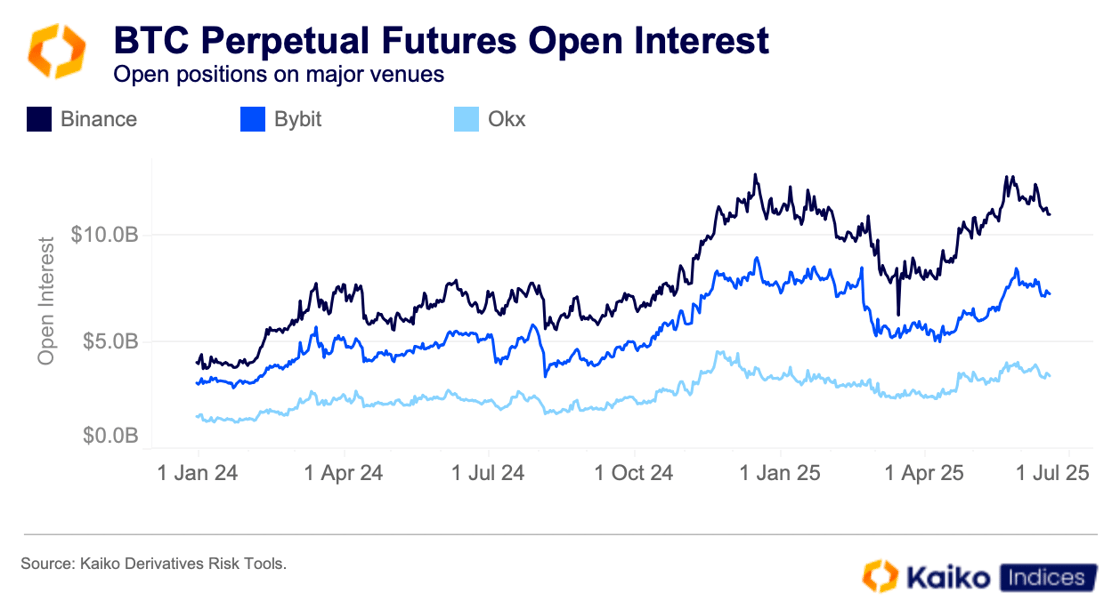

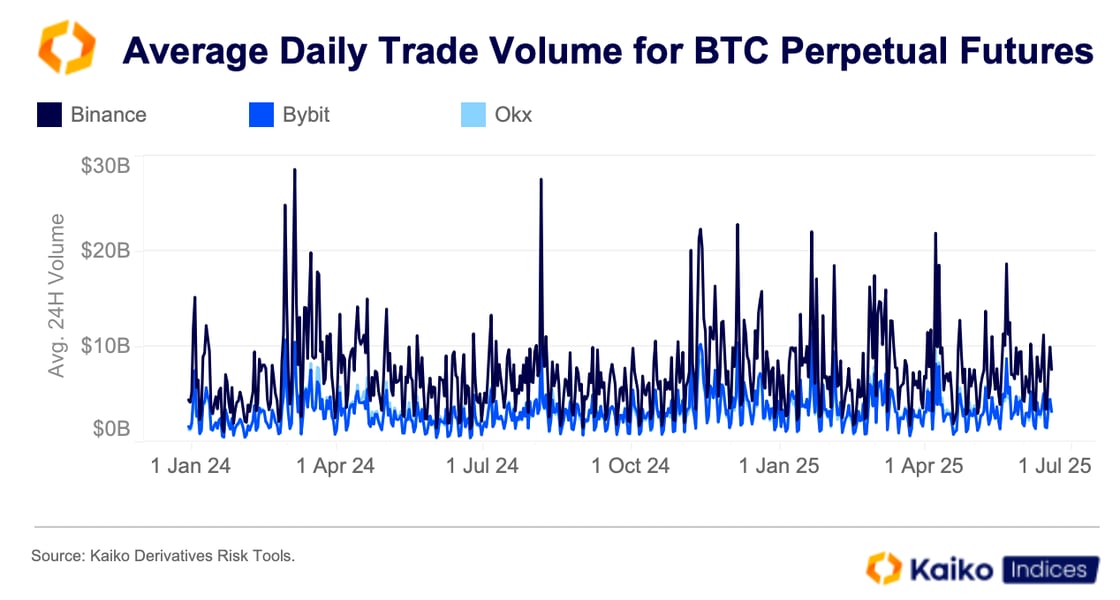

Derivatives make up over 75% of all trading activity in crypto markets. Perps account for 68% of all Bitcoin trading volume in crypto so far in 2025, up from 66% in 2024. The same market leaders in spot markets also lead in terms of market share for perps products. For example, Binance, Bybit, and OKX account for nearly 70% of open contracts on BTC perps.

The average daily trading volume of perps on these exchanges ranges from $10 billion to $30 billion, depending on the week. During periods of peak market activity, Binance has recorded as much as $80 billion in trading volume on BTC perps in a single day.

These products are currently traded offshore, but could become available in the U.S. following recent announcements by CFTC commissioners and Coinbase’s initiative to launch CFTC-compliant futures. In Europe, for example, One Trading has listed the first MiFID II-compliant perpetual futures accessible to institutional customers, supported by Kaiko’s BTC and ETH benchmark rates. With these major developments, we should see increasing volumes globally, driven by new regions such as the U.S. and new participants, including institutional investors.

Perpetual futures are key for crypto price discovery

In crypto markets, the relationship between volume and price discovery is quite straightforward. Higher volumes on one exchange, such as Binance, indicate that this venue is driving more price action. Typically, this happens in perps markets; however, at times in the past, volumes have been driven by activity in spot markets. Tracking the ratio of spot to futures volumes allows us to see which market is driving prices at any given time.

The ratio on Binance, the largest venue for both BTC spot and perps volumes, is currently around 12. This is its highest point since early 2024. Essentially, price discovery is being dominated by perps at the moment.

The ratio on Binance, the largest venue for both BTC spot and perps volumes, is currently around 12. This is its highest point since early 2024. Essentially, price discovery is being dominated by perps at the moment.

This has several implications for market structure as well as broader market risk, due to how perps track the price of the underlying asset. This is achieved through a mechanism called the funding rate.

Understanding funding rate risk

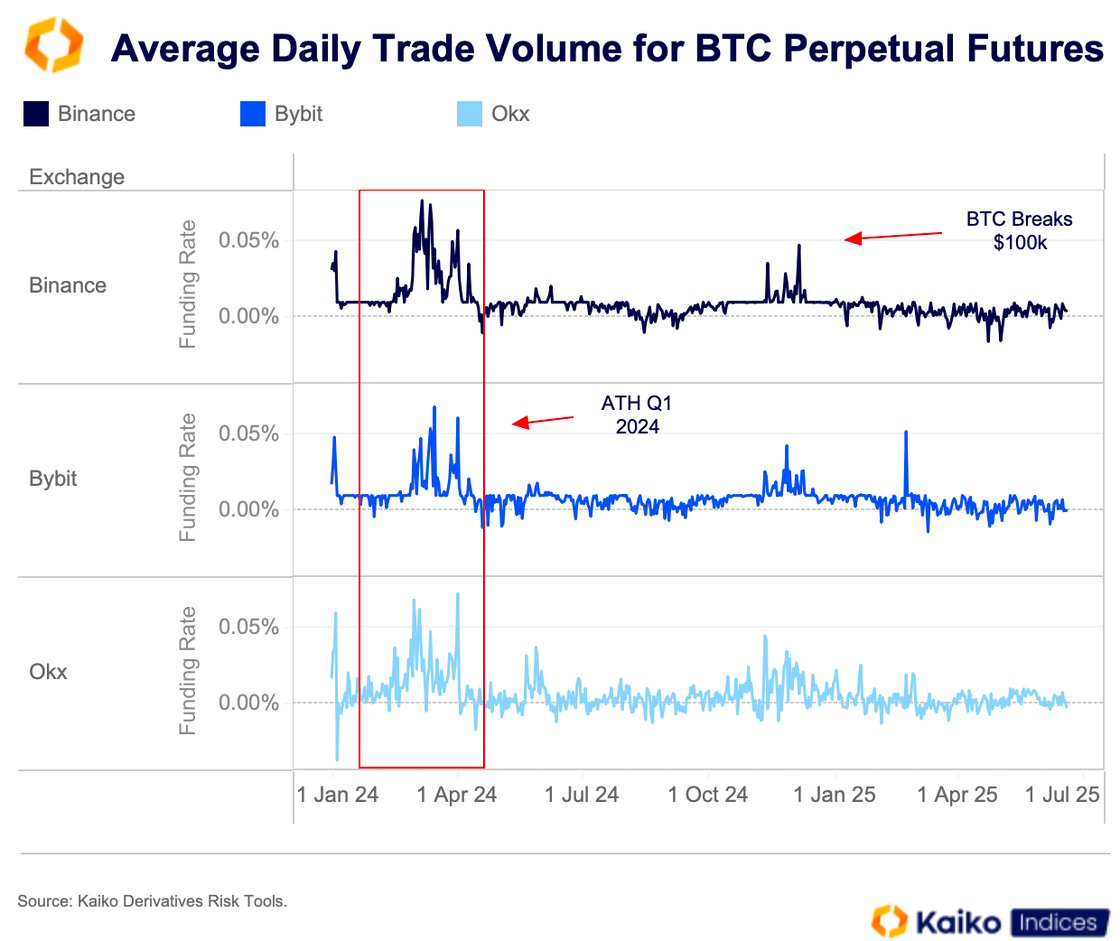

The funding rate is a fee charged for keeping a position open indefinitely, paid by either the long or short side depending on the demand imbalance. If there are more long positions (resulting in a positive rate), then the funding rate is paid by the long side to the short side, and vice versa. These rates are calculated every 4, 8, or 12 hours, depending on the exchange. Funding rates are based on the perps contract price during the calculation window, as well as the index price, which we discuss in more detail later.

When funding rates are excessively high, around 0.05% or more, this can indicate an abundance of leverage in the market as traders look to take advantage of price movements in BTC. This occurred last March as BTC broke $70k for the first time. In December of last year, funding rates spiked again as BTC rose above $100k.

During the recent record high above $112,000, there was a noticeable lack of movement in funding rates, despite the ratio of volumes being skewed toward perps on BTC. This is likely due to two factors: first, price action was supported by institutional bids from ETF investors and Bitcoin treasury companies; second, more sophisticated traders in perps were trading within their means to avoid the risks associated with excessive leverage.

Regulated benchmarks in perps

Beyond funding rates, there are also regulatory concerns with perps, especially regarding pricing and counterparty risk. Most trading happens on exchanges with little or no regulatory approval or oversight. This is because these platforms offer a wide variety of perpetual contracts on many assets, as well as large amounts of liquidity. The main issue is a lack of clear rules from regulators about whether regulated benchmarks are needed to support the listing and settlement of these products.

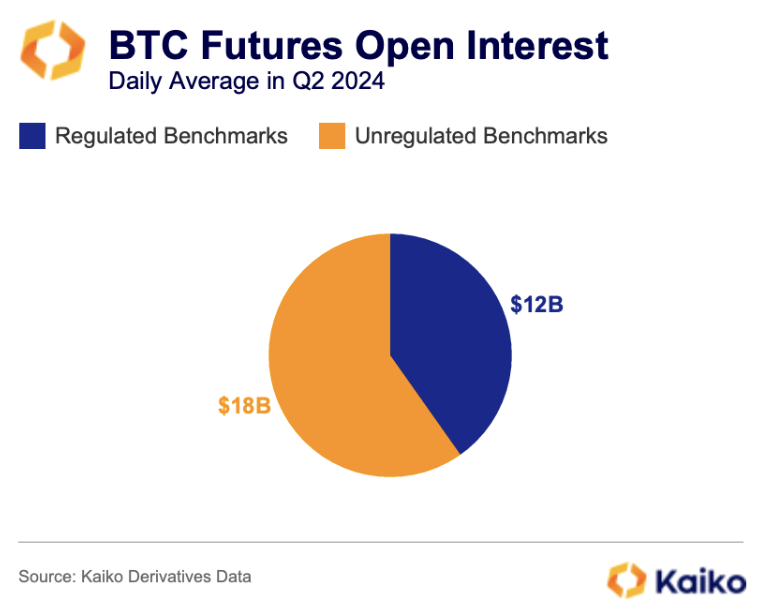

As a result, there is a second risk related to pricing and benchmarks for perps products. For the most part, BTC futures products are benchmarked against unregulated rates. In 2024, the daily average open interest relying on regulated rates, such as Kaiko Indices’ BMR-compliant rates, was $12 billion. By comparison, the daily average open interest on unregulated rates was $18 billion.

Index providers mitigate this risk through independent asset and exchange vetting processes as part of developing benchmark rates for perps contracts. For example, at Kaiko Indices, only a select group of exchanges are included in our BMR-compliant BTC rates. These venues must demonstrate sufficient liquidity and adhere to best business practices to be considered. In some cases, the availability of fiat pairs is also taken into account when computing rates.

As noted early, pricing also plays a significant role in calculating funding rates. Funding rates rely on computing the difference between the perps contact and the spot index price, depending on whether the perps contact is above (at a premium) or below (a discount) this can impact the funding rate calculation.

Inaccurate benchmark rates used to settle these products increase the risk of liquidations, as changes in funding can have significant effects on the broader market. Additionally, non-independent and inaccurate benchmarks open the door to manipulation and potential financial losses. A well-known example is the LIBOR scandal, in which banks manipulated benchmark interest rates, leading to billions of dollars in regulatory settlements and underscoring the dangers of unreliable benchmarks. It is critical for the crypto industry to learn from these mistakes and ensure robust, transparent, and independent benchmarks to protect market integrity and investor confidence.

Conclusion

Perps contracts pose a massive opportunity for U.S. crypto markets. The addition of widely available perps contracts on U.S. venues will likely exacerbate the disparity between spot and derivatives markets in crypto, as more traders gain access to these unique products.

However, this expansion requires some market structure considerations and presents challenges to existing infrastructure, particularly regarding regulated benchmark rates. Making these products available on CFTC-regulated markets will accelerate the maturity of crypto derivatives markets and drive the shift toward regulated, transparent practices in the broader crypto space.

Depending on the success of these contracts, from both a demand and regulatory standpoint, we could eventually see perps markets on equities or commodities. While traditional futures markets for these assets are well established, the unique features of perps markets might improve efficiency for some traders by removing the rolling costs associated with trading futures that are set to expire. As such, the opportunities in the U.S. related to perps are not necessarily limited to crypto, although they might hinge on how these products are rolled out in crypto markets.

More from Kaiko Indices

Fintech.TV x Kaiko Indices at NYSE

- Adam Morgan McCarthy joined Fintech.TV on the New York Stock Exchange floor this week to discuss perpetual futures markets, the BOLD index, and how regulation is shaping his market outlook.