Join us in Cannes for our Institutional Conference this Spring

Welcome to the index in focus!

Welcome to the Index in Focus! This week, we’re diving deep into Bitcoin. As the largest and oldest crypto asset reaches new record highs, we explore its role in today’s investment portfolios. We’ll examine how perceptions of its volatility are shifting and assess the performance of different allocation strategies.

-

BTC surges past $110k

-

How does it fit within traditional portfolios?

-

A model for evaluating BTC’s impact on portfolio returns

Where does Bitcoin fit in modern portfolios?

Bitcoin soared to new record highs above $110k amid strong buying demand from institutions and improved market conditions, as the U.S. administration makes progress on trade negotiations.

The latest rally, like most price movements over the past year, has been fueled by monumental demand from large investors. Buying pressure has been driven by investors in exchange-traded funds and by corporations mimicking Michael Saylor’s strategy.

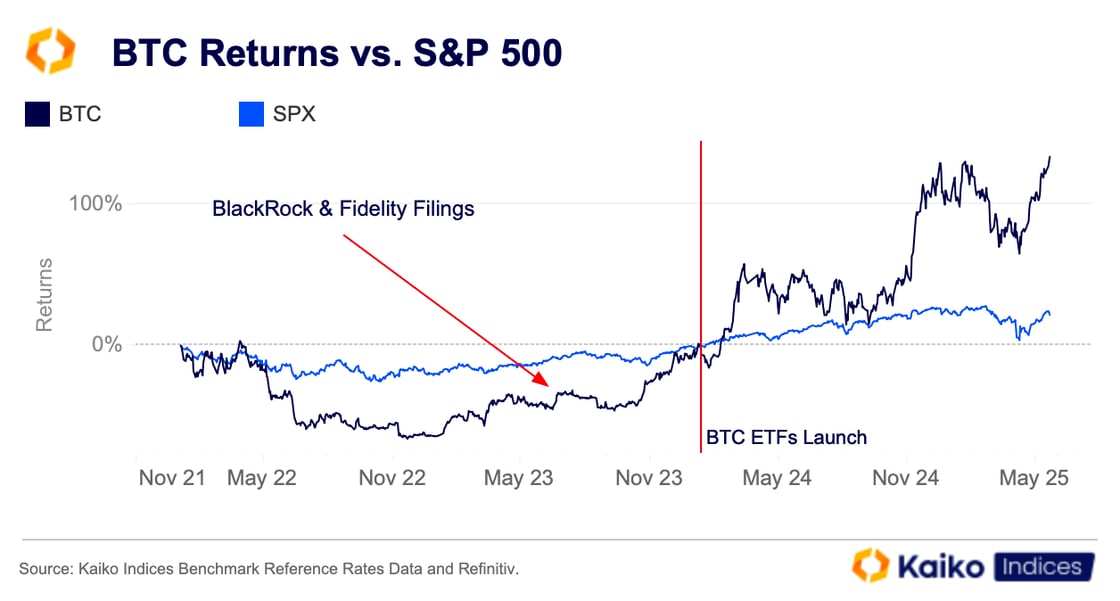

As a result of this demand over the past 18 months, Bitcoin has outperformed the S&P 500 index by over 100 percentage points, even as the broad-based U.S. stock index continues to set persistent record highs of its own.

This record performance, along with the advent of spot-based products in traditional wrappers, has opened up Bitcoin to a broader audience. Several pension funds in the U.S. and U.K. have even begun allocating funds to BTC ETF products. With this in mind, we ask: Where does Bitcoin fit in the modern portfolio?

Building Portfolios with Bitcoin

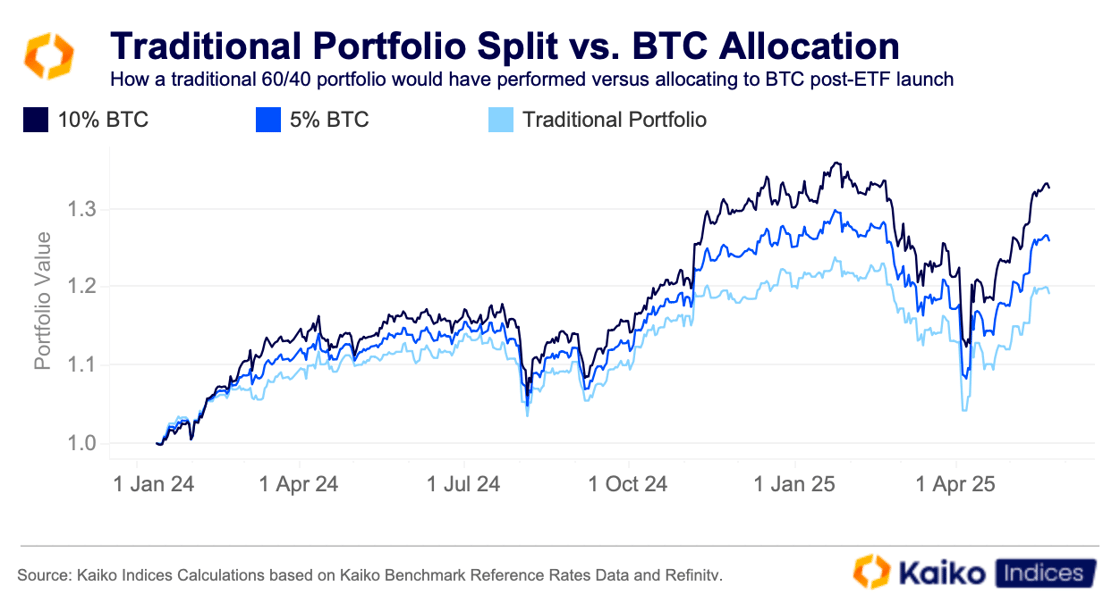

The traditional 60/40 portfolio, split between stocks and bonds, is ripe for change as investors look to improve returns in a post-Covid world, where inflation has exacerbated the cost of living crisis in nearly all major economies.

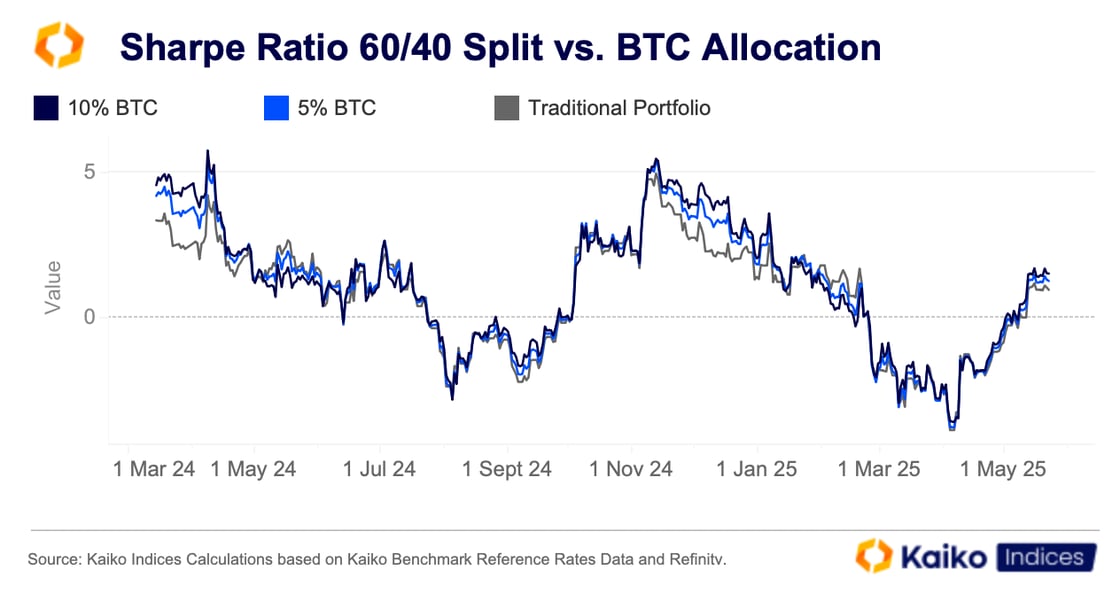

Using the Kaiko Indices Bitcoin reference rate in a hypothetical portfolio invested alongside the SPX ETF and U.S. 10-year bonds, we see that allocating either 5% or 10% of your portfolio to Bitcoin improves performance.

Changing volatility profile

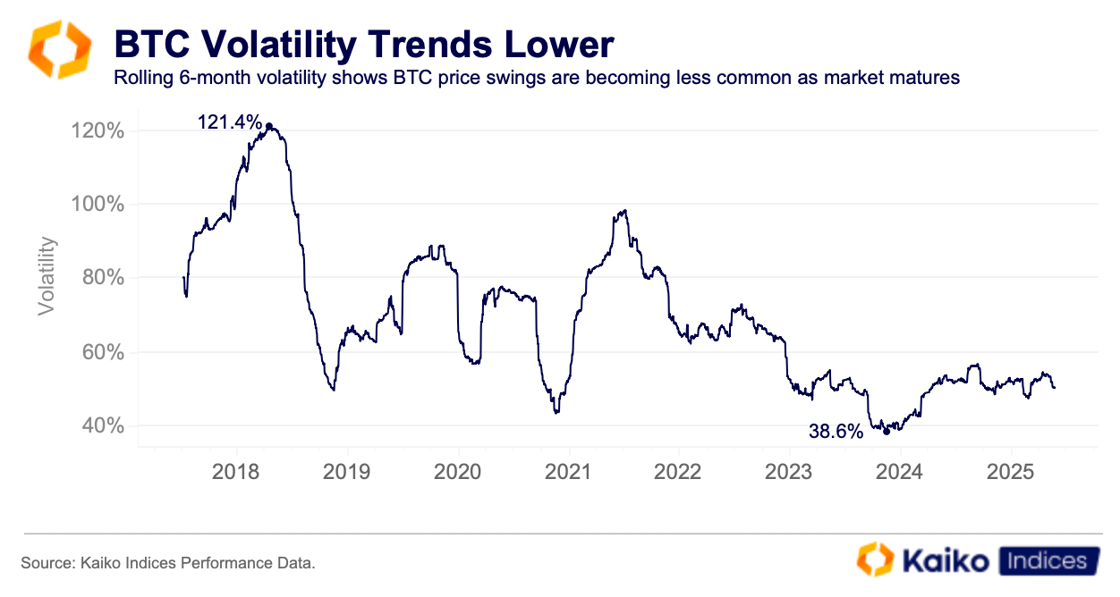

One of the most consistent arguments against including Bitcoin in a balanced portfolio has been its historical volatility. In its short history, Bitcoin has been prone to significant periods of volatility, with prices just as likely to surge 20% in a week as they are to crash 20% the following week.

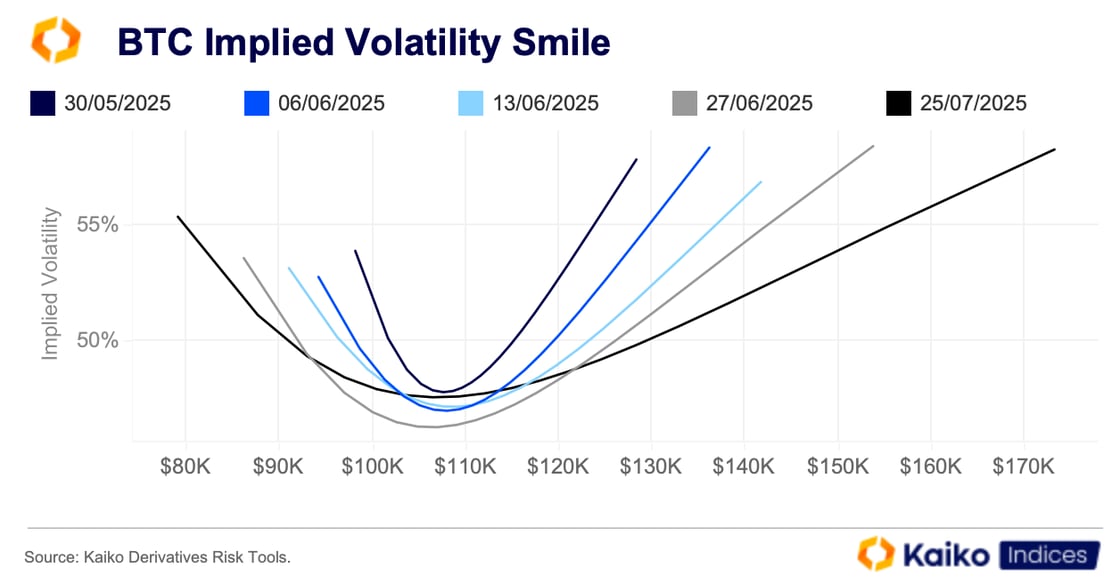

This kind of trading activity is reflected in Bitcoin’s implied and realized volatility profiles. Implied volatility for BTC options contracts on Deribit displays more of a volatility smile than a skew, since prices are often just as likely to move dramatically in either direction. This increases demand for out-of-the-money calls and puts.

Bitcoin’s historical 30-day realized volatility clearly shows these spikes, with peaks occurring around major market events in the past. However, realized volatility has rarely been above 60% since the beginning of 2023, despite trending slightly higher recently.

This is likely driven by the broader maturity of the Bitcoin market, particularly improved liquidity conditions. Lower liquidity in the past exacerbated price moves as broader markets declined, reinforcing Bitcoin’s volatility narrative. Indeed, as the asset’s volatility profile has shifted, it has become more palatable for most investors. Meanwhile, ETF investors held on more firmly last August when markets capitulated following the partial unwind of Japanese carry trades amid heightened macro uncertainty at the time.

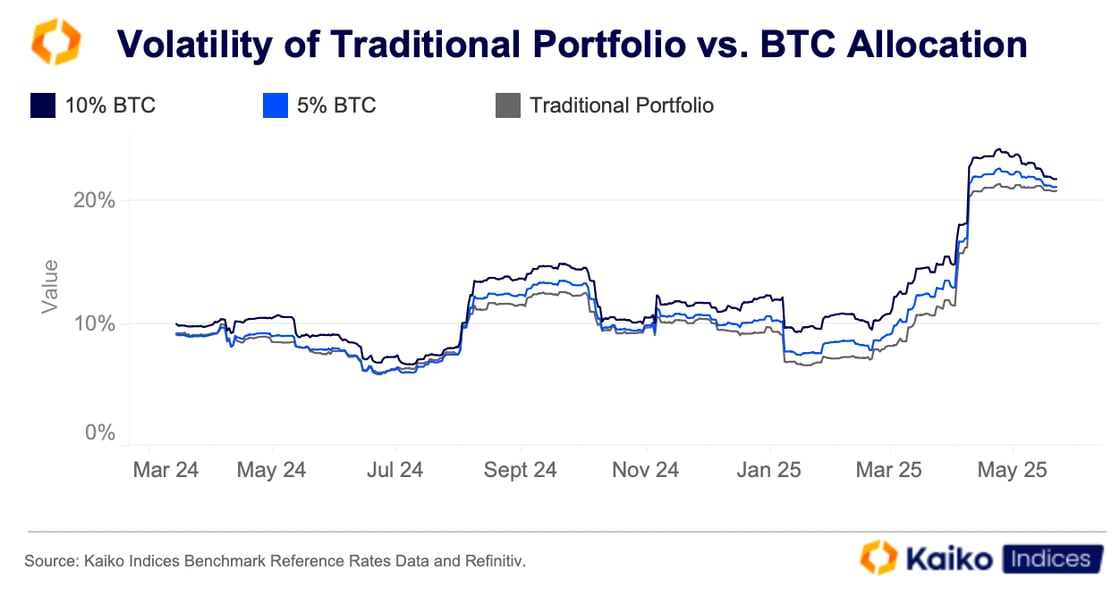

So, what would adding Bitcoin to a balanced portfolio of stocks and bonds mean for volatility? According to the data, not much. Each of the theoretical portfolios experienced upticks in volatility in April, following the Liberation Day tariffs. While the 60/40/10 split did see a slightly more pronounced spike, it was negligible, and the three portfolios continue to be closely aligned.

What about risk?

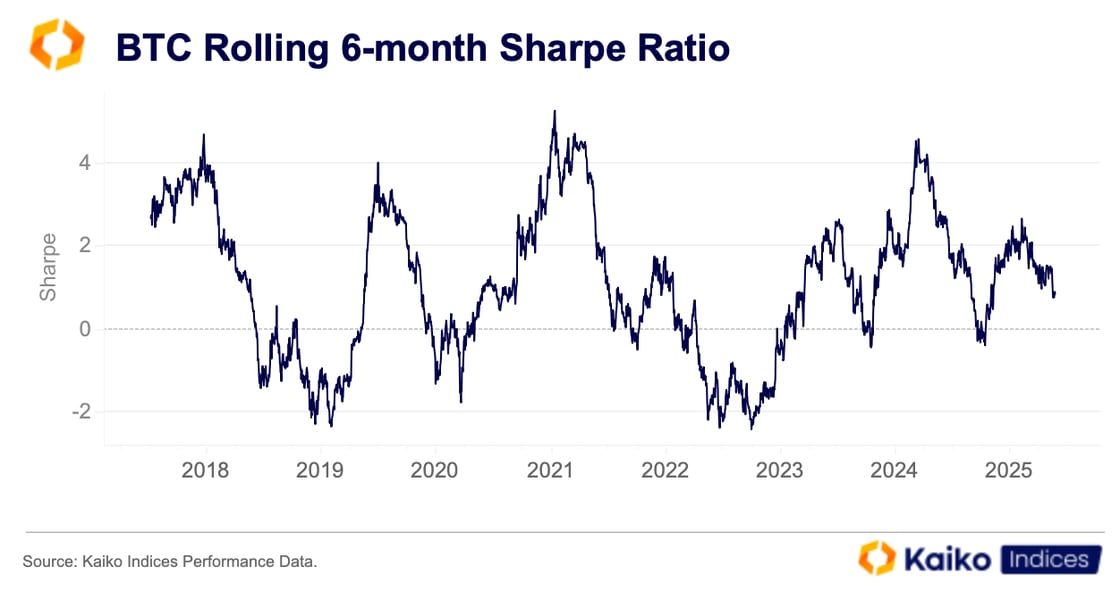

Bitcoin’s risk-adjusted returns have naturally tracked its volatility profile, whipsawing throughout its early history. More recently, its Sharpe ratio has remained above 0, reaching as high as 4 at times last year.

A Sharpe ratio between 0 and 1 indicates low risk and low reward, while anything over 2 is considered very good. Essentially this means BTC offers good risk-adjusted returns.

This pattern is reflected in the traditional 60/40 portfolio—split between stocks (SPX ETF) and U.S. 10-year bonds—where any allocation to Bitcoin further improves the Sharpe ratio.

Conclusion

Bitcoin’s rapid rise and its growing presence in traditional financial portfolios highlight just how far the asset has come since its inception. As the data show, even modest allocations to Bitcoin can enhance portfolio performance without meaningfully increasing volatility, and risk-adjusted returns have become increasingly compelling as market infrastructure matures.

While volatility remains a consideration, the narrative is changing. Bitcoin is no longer just a speculative outlier, but is potentially a credible addition to balanced portfolios, offering crucial diversification benefits for institutional and retail investors alike. As the investment landscape evolves in the post-Covid era, Bitcoin’s role in the modern portfolio is set to expand even further.