Join us for our latest webinar in collaboration with Cboe

Beyond the Buy: A New Model Emerges for DATs

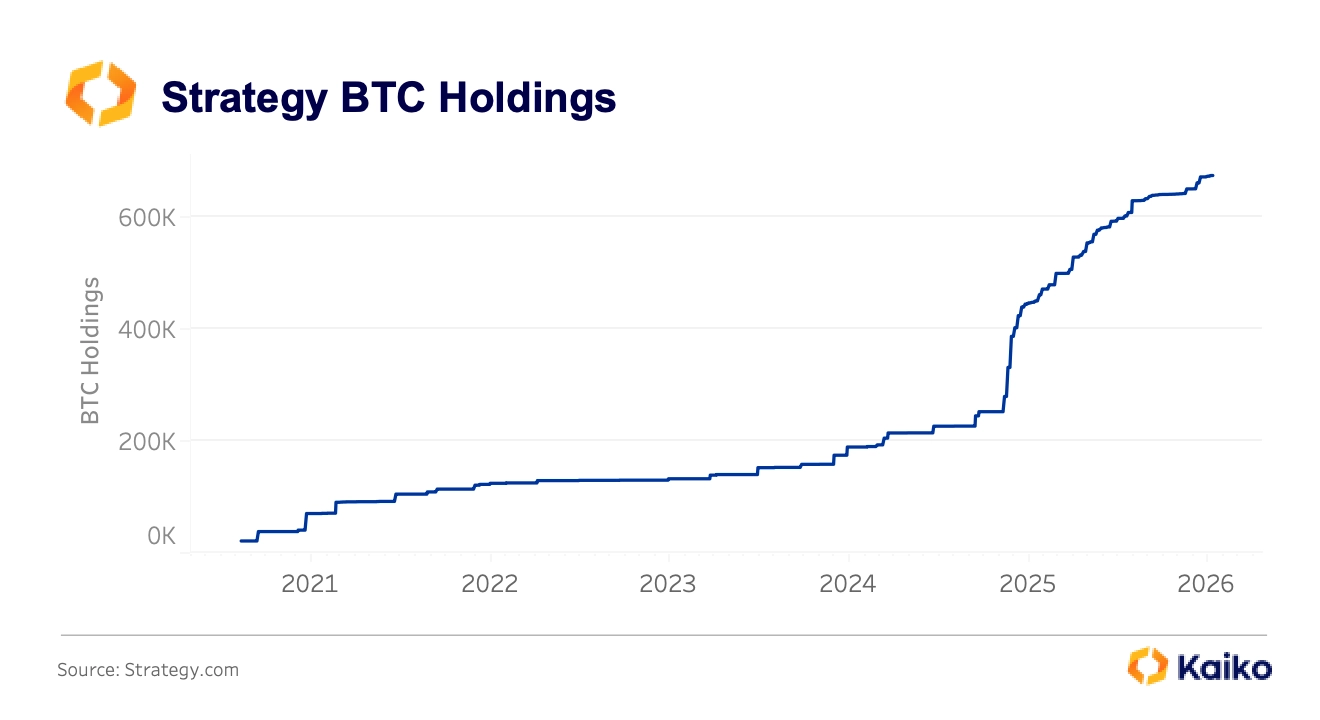

The digital asset treasury playbook just got rewritten. For years, corporate crypto strategies followed a simple script: raise capital, buy Bitcoin, hold forever, repeat. MicroStrategy turned this into an art form, accumulating over 600,000 BTC and transforming itself from a software company into a de facto Bitcoin operating company. The model worked brilliantly at times but it had one glaring limitation: revenues were entirely tied to price appreciation and capital markets access.

Now, a new model is emerging, as digital asset treasuries (DATs) move beyond buy and hold strategies and look toward creating value for investors and network participants. Nasdaq-listed Tharimmune raised $545 million from DRW, Liberty City Ventures, Kraken, Polychain Capital, and many others not to passively accumulate tokens, but to actively participate in the Canton Network as a super validator. The biotech firm is pivoting entirely, with plans to run validator nodes, earn block rewards, and build applications on the network.

The limits of passive accumulation

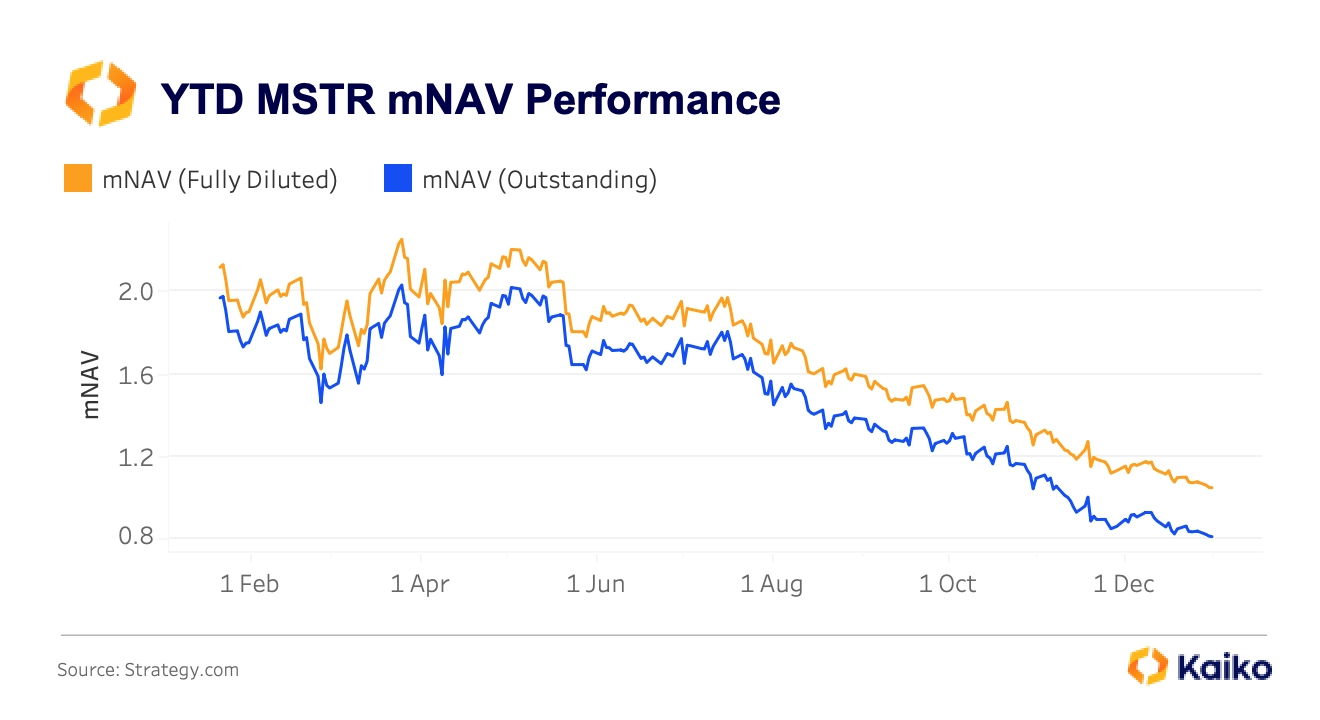

The original DAT model pioneered by Strategy (formerly MicroStrategy) relied heavily on Bitcoin’s price appreciation. Higher prices created a net asset value (NAV) premium, which enabled equity issuance at elevated valuations, funding more Bitcoin purchases.

At its peak, Strategy’s market cap traded at a 68% premium to its Bitcoin holdings, effectively monetizing market enthusiasm and accessibility. However, the premium has been falling and access to Bitcoin has never been easier thanks to spot exchange-traded funds. When you take these two things away the value proposition is much different.

The simple buy and hold DATs model hinges on these two variables: access and the underlying asset price. There’s no recurring revenue from this model, no operational cash flow tied to the assets themselves. Just the hope that prices rise, premiums persist, and capital markets remain receptive. As we’ve shown in our research, this unravels in a bear market.

As crypto infrastructure has matured, so too have the opportunities to generate actual returns from digital assets, not just on them. Proof-of-stake networks like Ethereum and Solana offer native staking yields of 3-5% annually. DeFi Development Corp goes further, issuing a liquid staking derivative of SOL, that allows users to stake their SOL while retaining liquidity for use across DeFi. The firm doesn’t just earn staking rewards, it collects fees from the structured product and builds network effects through protocol integrations.

Decentralized finance (DeFi) protocols provide structured lending and liquidity products. And blockchain networks increasingly allow institutional participants to operate validators, collect delegation fees, and earn transaction rewards. Digital assets can be more than just stores of value, they’re also productive capital.

Validators as revenue engines

Tharimmune’s approach to holding digital treasury represents a new model. Rather than simply buying and holding Canton Coin, Tharimmune plans to become a validator on the Canton Network.

Running a validator node means earning block rewards, collecting fees from delegators, and participating in network governance. It’s recurring, protocol-level income that doesn’t rely on token price appreciation. More importantly, it positions the company not as a passive holder, but as critical infrastructure within the ecosystem.

Tharimmune is not alone in utilizing this model, in fact it’s already gaining traction. Sol Strategies operates its own Solana validator to generate predictable returns. Elsewhere, Evernorth plans to use its XRP holdings to generate yield through lending on-chain and through traditional yield generating methods. Even Metaplanet, a MSTR copycat out of Japan, has signaled plans to use its Bitcoin holdings as collateral to raise cash for acquiring revenue-generating businesses. The writing is on the wall for buy and hold strategies.

FROM PREMIUM TO MULTIPLE

The shift from DAT 1.0 to 2.0 is ultimately about transitioning from a premium to a multiple. In traditional equity markets, companies trade at multiples based on expected earnings, not just book value. DAT 1.0 firms traded at premiums sometimes massive ones but those premiums were speculative, tethered to sentiment and capital markets dynamics. The moment confidence erodes, the premium collapses.

DAT 2.0 firms, by contrast, are building businesses that justify multiples. Validator operations, structured yield products, and on-chain financial services create recurring revenue streams that can be modeled, projected, and valued. Investors aren’t just betting on asset appreciation they’re underwriting cash flows.

This isn’t theoretical, companies like DeFi Development are already being valued not just on their SOL holdings, but on the revenue potential of their validator operations and derivative issuance. The premium may shrink, but the multiple the market’s recognition of sustainable earnings can persist.

Accurate pricing becomes critical as this model takes hold. If DAT 2.0 firms are going to trade on multiples rather than premiums, the underlying rates they use to structure products need to be transparent, reliable, and compliant. Investors underwriting cash flows won’t tolerate opaque benchmarks or backfilled data. They need rates that reflect real market conditions and can withstand regulatory scrutiny.

That’s how Kaiko works with firms like Tharimmune to provide compliant, auditable pricing. As validator revenues and staking yields become core to valuations, having defensible rate infrastructure isn’t optional anymore. It’s the foundation for moving from speculation to sustainable business models.

Why pricing matters and DATs will be explored further in March at The Agora, the only unsponsored institutional digital assets event. Held annually in Cannes, France, The Agora is organized by Kaiko and brings together industry professionals from across the global ecosystem. Secure your spot today with 20% off until January 30, 2026.

the road ahead

Not every DAT will make the leap, some will maintain the buy-and-hold model, hoping premiums return. Others will struggle with execution, unable to navigate the operational complexity of running validators or building financial products. Most of these complexities can be overcome by partnering with firms who have deep industry expertise. This isn’t just about working with an embedded rate provider like Kaiko, but even partnering with on-chain teams, as Evernorth and others plan to do.

But for the firms that get it right, the opportunity is enormous. As blockchain networks mature and institutional adoption accelerates, the demand for credible, compliant validator operators will only grow. DATs that position themselves as infrastructure providers not just asset holders will capture that demand.

Tharimmune’s $545 million bet isn’t just a pivot, it’s a signal. The end of an era for the passive digital asset treasuries approach. The era of operational crypto infrastructure companies is just beginning.

MORE FROM KAIKO

![]()

Perspectives

Paris

Beyond the Buy: A New Model Emerges for DATs

Learn more about how digital asset treasury strategies are moving beyond passive accumulation.

16/01/2026

Read More![]()

Company

New York

New Change FX and Kaiko partner to deliver regulated Benchmark FX data on the Canton Network.

Kaiko, the global leader in institutional digital asset market data and infrastructure, and New Change FX (NCFX), the FCA-regulated global leader in independent FX benchmark rates, today announced a strategic collaboration to bring high-quality, re...

07/01/2026

Read More![]()

Company

New York

Kaiko and AfterData Partner To Deliver a MiCA-compliant Market Abuse Detection Solution Tailored to the French Market

11/12/2025

Read More