Join us in Cannes for our Institutional Conference this Spring

How market surveillance solutions can help regulators prevent crypto price manipulation

With the number of cryptocurrencies, innovations, and investment vehicles growing fast, the need for proper regulatory oversight in the crypto sector grows too. Market manipulators are increasingly taking advantage of small, low liquidity assets and new technologies to manipulate market conditions, allowing them to profit from illegal price manipulation. As a result, to avoid gaps in their enforcement strategy and take action fast, regulators need to be ready and have the necessary solutions in place to spot warning signs at market-scale, across every asset on every exchange.

We’ve already seen several examples of price manipulation occurring on smaller assets across DeFi and CeFi ecosystems that caused devastating results, highlighting the importance of a complete market view. In this blog, we explore one of these manipulations, investigating what happened and how a high-quality market surveillance solution could be used to detect and counter such events.

manipulation-in-action – Jelly-my-jelly

Date: March 26, 2025

What is Jelly-My-Jelly?:

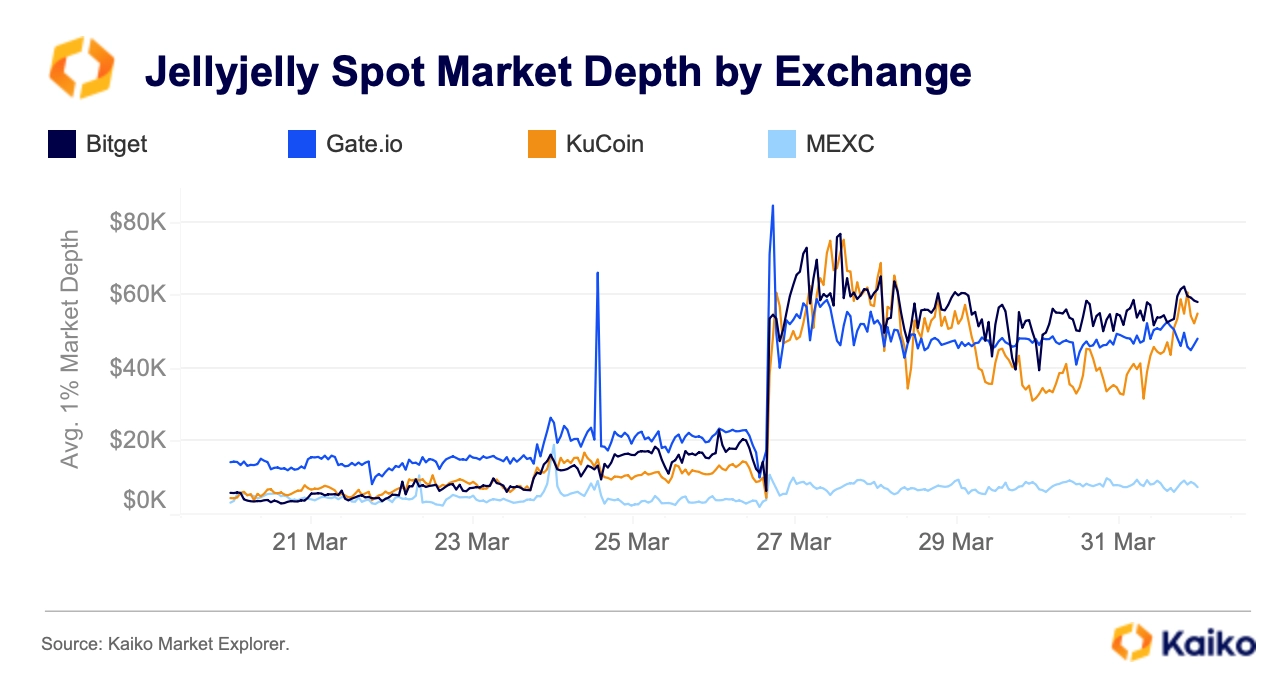

Jelly-My-Jelly is a Solana-native token listed on both centralized (CEXs) and decentralized (DEXs) exchanges. At the time of the event, it had a modest $15M market cap versus SOL’s which is currently over $80bn. Its daily liquidity, as measured by 1% market depth, averaged at just $72K. Market depth assesses volume of bids and asks on an exchange at each price-level, and is one of the many metrics available in Kaiko Market Surveyor.

What Happened?:

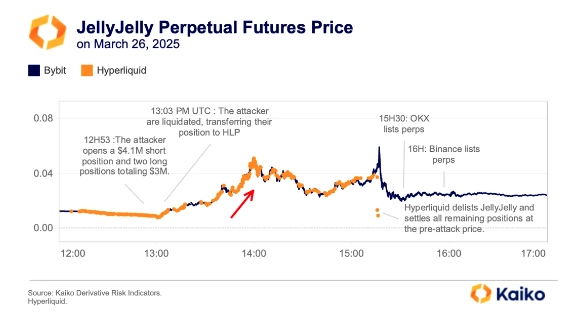

A trader attacked Hyperliquid’s Liquidity Provider (HLP) vault by opening large positions in Jelly-My-Jelly’s perpetual futures market: One short worth ~ $4 million, and two longs totaling ~ $3 million. For this attack, the trader carried out two coordinated actions while simultaneously opening short and long positions on the asset’s perpetual markets:

Forced Liquidation

The manipulator withdrew the margin supporting the short, triggering its forced liquidation and shifting the burden onto Hyperliquid’s HLP vault, leaving it vulnerable.

Spot Market Pump

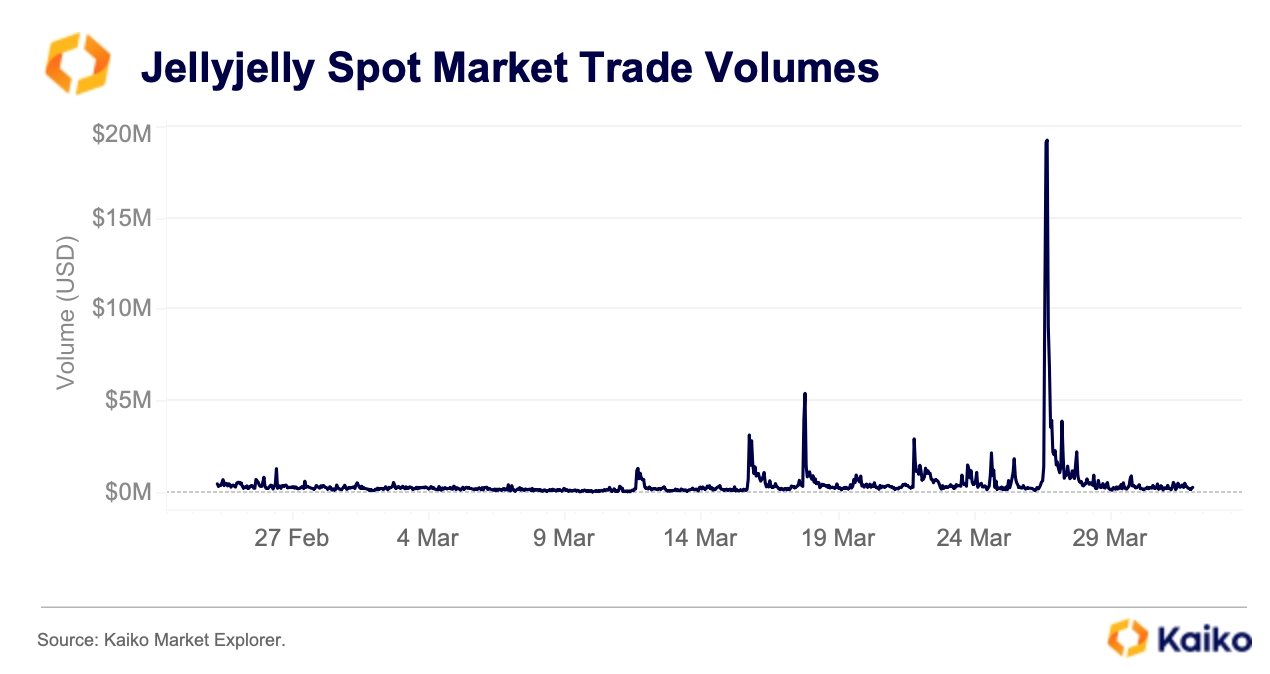

They also bought Jelly-My-Jelly on spot markets, causing a sharp price spike. As Hyperliquid’s perpetual settlement relied on a spot-price-derived oracle, the manipulation immediately inflated perp prices. Trade volume data, which would have been available as a real-time feed at the time in Kaiko Market Surveyor, highlights the impact this had on the market.

The Consequences:

Within an hour, Jelly-My-Jelly’s price surged over 500%, jumping from $0.00806 to $0.0517. Using liquidation data from Kaiko’s Derivatives Risk Indicators and Hyperliquid, you can see in the graph below how the manipulation played out over a 4-hour period.

This price manipulation exposed cracks in Hyperliquid’s liquidation engine. As open interest exceeded key thresholds, new positions were blocked, preventing liquidators from effectively closing the liquidation of the attacker’s short position. This delay amplified losses, further worsening the situation for the HLP vault.

Adding fuel to the fire, Binance and OKX listed Jelly-My-Jelly perps on the same day, following a surge of activity on Bybit, where Jelly-My-Jelly hit its highest-ever daily volume at $150M.

These operations and timings show just how calculated the attack was. On-chain data from Kaiko revealed that, as early as 10 days before the attack on March 26, the attacker was already running test transactions on Hyperliquid, likely to refine their strategy.

Overseeing the market to maintain integrity

The Jelly-My-Jelly incident highlights how fraudulent price manipulation can quickly undermine smaller cryptocurrencies and allow illicit entities to profit.

In order for regulators to tackle the threat of market manipulation, they need to develop capabilities to ensure exchanges are doing the proper checks and conducting effective surveillance over their users’ trades. For those in the EU, this is enshrined in the MiCA legislation:

Markets in Crypto-assets Regulation (MiCA) – Article 60 (14)

“The competent authorities shall establish and maintain effective arrangements, systems, and procedures to detect and report suspicious orders and transactions that could constitute market abuse”.

To do this effectively, complete market-level visibility is the key. With a full view of the market, regulators can survey the areas they are responsible for and investigate further when signs of potential market manipulation appear. This is critical to overseeing the entities they license and holding them to account in line with the terms agreed.

How Kaiko Market Surveyor helps regulators tackle market abuse

Designed to empower regulators to detect, screen, and prevent market abuse like the Jelly-My- Jelly incident, Kaiko Market Surveyor provides the critical market data and visibility needed to conduct effective trade surveillance.

Offering real-time oversight of CeFi and DeFi markets, Kaiko Market Surveyor helps regulators oversee all markets simultaneously, ensuring that behaviours like insider trading, spoofing, wash trading, and layering can be detected in the moment. This ensures regulators can act quickly on red-flags and limit the potential damage of a manipulation event.

With Kaiko’s market-leading data powering trade surveillance efforts, regulators can automatically analyze suspicious trading patterns and signs of fraud systematically, allowing for effective and justified alerts. This helps the compliance team to focus on the activity that really matters and ensure they aren’t inundated with false alerts.

The Jelly-My-Jelly incident is just one of many market manipulation events that has worked to undermine the crypto industry. Regulators who aim to get on top of this activity, need to have the right, data, tools and knowledge to effectively identify and prevent market abuse. With Kaiko Market Surveyor regulators can do just that, overseeing the crypto market in real-time and identifying market manipulation patterns to enforce regulatory requirements.

Book a call with our expert team today to discuss how Kaiko Market Surveyor can help you efficiently uphold your regulatory regime.

MORE FROM KAIKO

![]()

Indices

New York

Kaiko Selects Blue Ocean Technologies Data to Power 24/7 Equity Perpetual Futures

Kaiko is pleased to announce our selection of Blue Ocean Technologies LLC, a capital markets fintech leader in global trading and data, to provide critical overnight market data for a selection of Kaiko’s Equity Rates.

12/02/2026

Read More![]()

Indices

New York

How Kaiko’s oracle and institutional rates power Kinetiq’s 24/7 global on-chain perpetual markets

Learn more about how we’re enabling the next generation of on-chain perpetual futures trading on Kinetiq Markets.

10/02/2026

Read More![]()

Perspectives

New York

Davos, Macro Drivers & Crypto Implications

As prediction markets scale to billions in volume, pricing infrastructure must evolve beyond single-venue dependencies, or systematic manipulation will remain a risk.

28/01/2026

Read More