We're hiring! Discover our culture and explore open roles.

The Importance of Independence Amidst Crypto Industry Consolidation

October 15th, 2024

This year has brought substantial transformations to the cryptocurrency industry, highlighted by the introduction of crypto ETFs in the United States. Kaiko’s research indicates that these financial products are reshaping crypto market liquidity in two ways:

Distribution: Heightened trading volumes during U.S. market closures driven by NAV calculations, and uneven benefits across execution venues.

Volume: Increased activity from new entrants, as ETF market makers engage in trading and hedging activities.

Widespread adoption of exchange-traded and structured products is observable:

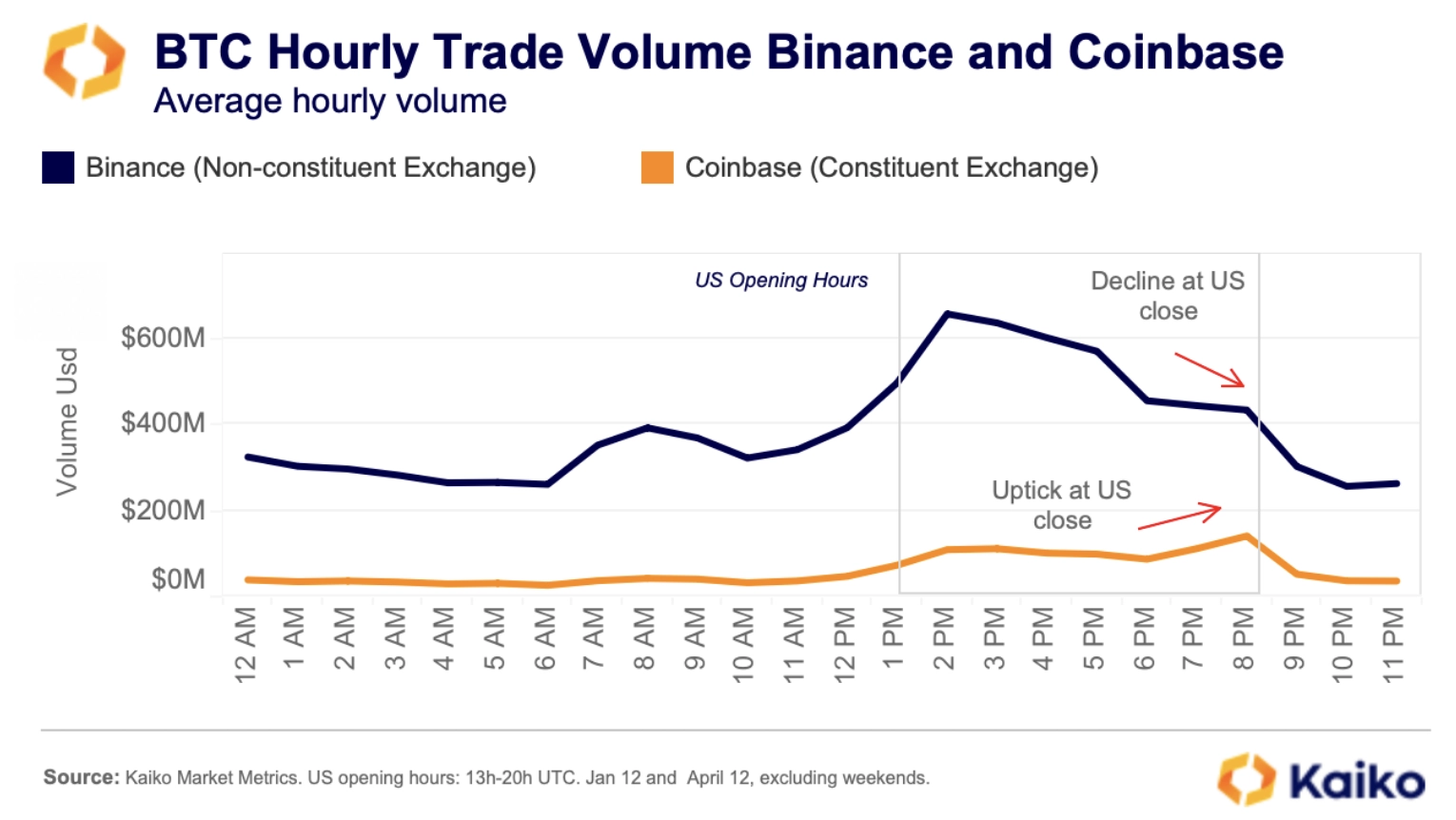

The above chart, extracted from Kaiko’s research, shows that exchanges have a business incentive to be a constituent source of the Indices, as this generates volume driven by ETPs/ETFs and structured product operations. These financial products rely heavily on their underlying index.

Market Structure and Independence

One might wonder about the influence of the indices on market structure. As the industry consolidates, what does ownership of Index providers by exchanges mean for the independence of said indices and reference rates? Will exchanges resist the temptation to skew the indices towards themselves when they own the business?

The independence question has further ramifications. Indices—not regulated per se in the US, but regulated in the EU and often audited (IOSCO)—are essentially data products. While proprietary methodology and significant IP and resources are required for proper engineering and operation of indices, they are derived from source feeds—the exchange market data itself. Exchanges in crypto have gone through a similar cycle to equities 20 years ago, monetizing their market data, often leveraging market data providers as facilitators.

Conflict of Interests’ Impact on Data Accessibility

This creates a second dependency: Index providers need to be licensed by the source exchanges. Additionally, index providers are often data providers as well—as is the case with Kaiko, operating under BMR as a separate business. This raises another question: Will exchanges idly watch other exchanges monetize their market data through a data provider or index arm? How can this ultimately scale without creating inherent conflicts of interest?

Looking Ahead

Since 2014, Kaiko’s independence has been a strategic priority, sometimes necessitating hard capital decisions to maintain this independence. As the market consolidates, strong businesses will likely seek synergies and vertical integration. If exchanges move towards absorbing index providers and market data providers, the integrity of the value chain may be at risk. Will an exchange-owned data provider like CMC (Binance-owned) maintain its licenses from competing exchanges?

Without licensed independent market data providers and independent index providers, what will the downstream value chain look like?

In a recent interview with Bloomberg, Raghu Yarlagadda, FalconX’s co-founder and chief executive said he expects a “wave of consolidation” in 2025.

In 2025, the crypto industry will certainly have shed its current skin through consolidation. The winners of this process will shape the future of the market and determine its strength for the next cycle.

Ready to Get Started with

Kaiko?

Our Data solutions are used by 200+ clients globally. Get in touch to request a demo and discover how they can help you.

MORE FROM KAIKO

![]()

Company

New York

Kaiko and AfterData Partner To Deliver a MiCA-compliant Market Abuse Detection Solution Tailored to the French Market

11/12/2025

Read More![]()

Company

New York

Kaiko and Kinetiq Bring 24/7 Global Perpetual Markets On-chain

Kaiko and Kinetiq pioneer 24/7 global on-chain perpetual markets, powered by Kaiko’s HIP-3 oracle infrastructure.

10/12/2025

Read More![]()

Company

New York

Kaiko Introduces Real-Time Equity Rates, Unlocking 24/7 Equity Markets

Kaiko is expanding its benchmark infrastructure with the introduction of real-time stocks and equity ETF rates designed for continuous global markets.

03/12/2025

Read More