Join us in Cannes for our Institutional Conference this Spring

Kaiko launches DeFi Lending & Borrowing data

November 29th, 2022

Crypto market data available across leading ethereum L&B protocols encourages transparency around blockchain lending activity.

Recent market events have highlighted the necessity of decentralized finance in crypto markets, and the launch of Kaiko’s DeFi Lending and Borrowing data is a further step in showcasing the value of decentralized finance. Today, Kaiko announces the launch of market data for DeFi Lending and Borrowing protocols for the crypto finance and institutional communities.

Kaiko’s crypto market data for L&B offers exposure to three of the leading decentralized L&B protocols: AAVE, Compound, and MakerDAO. These decentralized protocols currently hold $15B, which is more than 78% of the total global liquidity locked-in lending protocols. The five transactions available on these three L&B protocols, known as events, constitute: borrows, deposits, repayments, withdrawals, and liquidations. The data underlying these transactions is now available to Kaiko’s clients via a single API market data offering.

DeFi offers users full ownership of the crypto assets; self-custody means that the user does not need to rely on a third-party intermediary. In addition, DeFi is permissionless, universally accessible, and transparent. Another benefit to DeFi is its composability, which allows users to leverage different combinations of existing protocols and decentralized applications without sourcing permission, enabling the users to be agile when selecting the strategies that work for them.

Use Cases

Kaiko’s crypto market data offering is a gateway to decentralized finance. L&B market data can be used in numerous use cases including;

- Optimizing trading strategies

- Powering DeFi applications

- Monitoring the market

- Research & analysis

- Yield analysis

- Tracking wallet movements.

By providing granular and transparent data on all lending activity happening on the blockchain, Kaiko’s data product empowers clients to make more informed decisions by tracking other users’ strategies, allowing them to manage risk better.

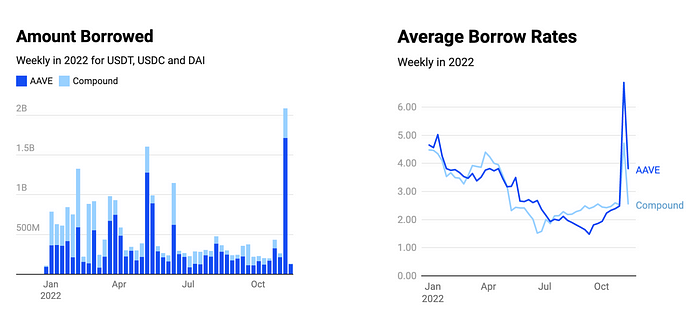

Get a comparative view on borrow rates across lending protocols, and monitor in real-time the amounts borrowed on several platforms, for all the available tokens.

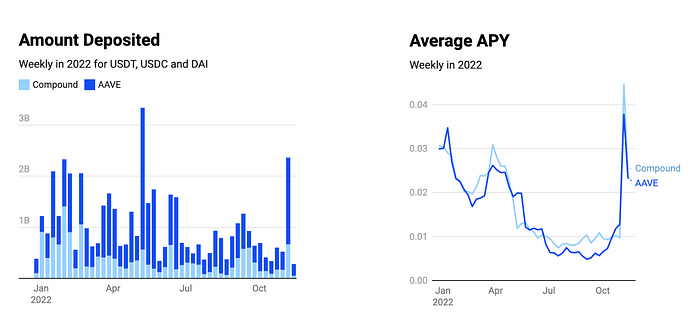

Get a comparative view on APYs across lending protocols, and monitor in real-time the amounts deposited on those platforms, for all the available tokens.

Kaiko’s introduction of DeFi L&B market data expands on Kaiko’s launch of DEX data earlier this year. Kaiko’s DeFi market data is a unique tool for any institution active on or considering DeFi.

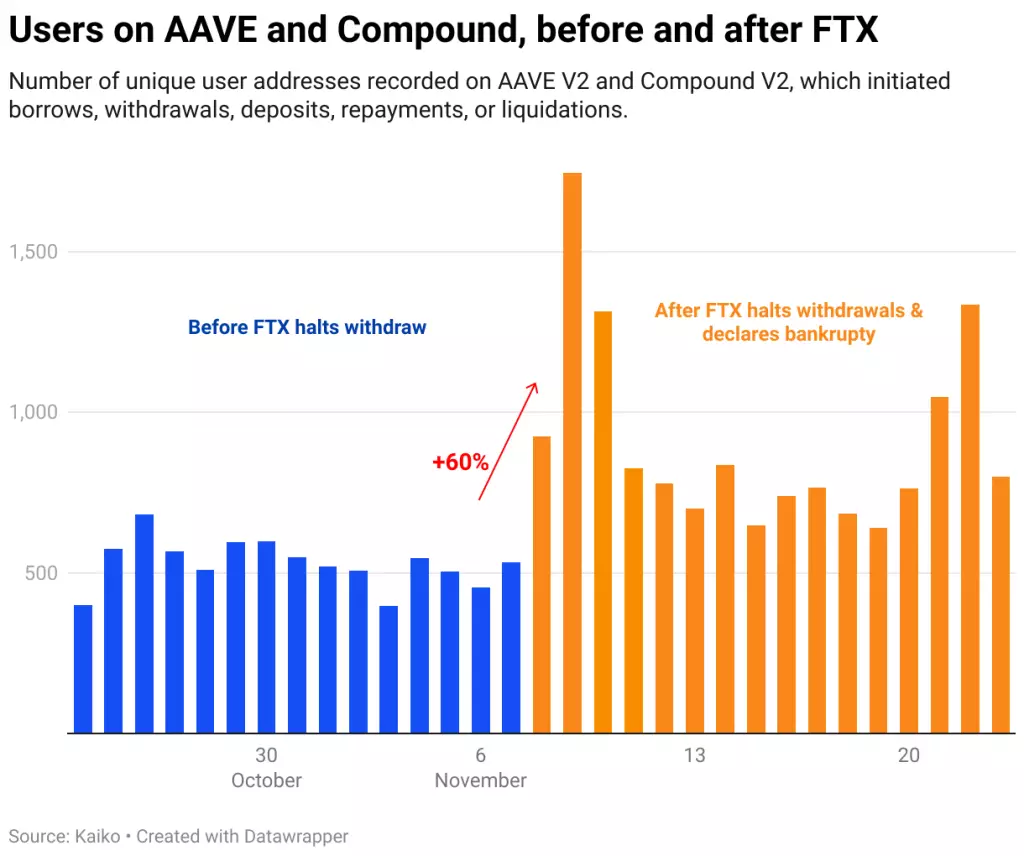

The FTX collapse has led to a lack of trust in unregulated and non-transparent centralized cryptocurrency intermediaries. This has started to be addressed by the most advanced centralized intermediaries for a better risk management framework. Amongst the immediate expected beneficiaries, is decentralized finance protocols as lending protocols, which have immediately seen their user base increase, attracting more and more users thanks to the transparency and financial opportunities they offer. Data shows us that AAVE’s and Compound’s user base has increased by 60%, right after FTX announced it had halted withdrawals.

Ambre Soubiran, CEO of Kaiko commented, “Kaiko’s lending and borrowing data represents immense value for trading and risk management, as well as facilitating a deep understanding and monitoring of DeFi markets. Our data is underpinned by trust, and provides transparency on all financial aspects of the crypto industry, helping crypto market participants make informed decisions to optimize their capital.”

Learn more about Kaiko’s L&B data here.

Contact us for more information.

Never Miss An Update

MORE FROM KAIKO

![]()

Perspectives

New York

From Crisis to Confidence: Building Regulated Infrastructure for Tokenized Collateral

The 2022 UK gilt crisis revealed a critical gap with three unsolved problems for the adoption of tokenized money market funds at scale.

05/03/2026

Read More![]()

Partnerships

New York

Kaiko and Ownera Announce SuperApp Collaboration to Deliver Market Data Across the Ownera Ecosystem

Kaiko Data Services SuperApp enables banks, asset managers, and custodians to access institutional-grade market data natively across the Ownera SuperApps Platform.

05/03/2026

Read More![]()

Perspectives

New York

Building An Institutional-Grade Oracle: Know Your Source Means Know Your Risk

Most smart contracts rely on opaque off-chain data feeds. Learn how oracle architecture works, where it fails, and how transparent, auditable design is key.

05/03/2026

Read More