Join us in Cannes for our Institutional Conference this Spring

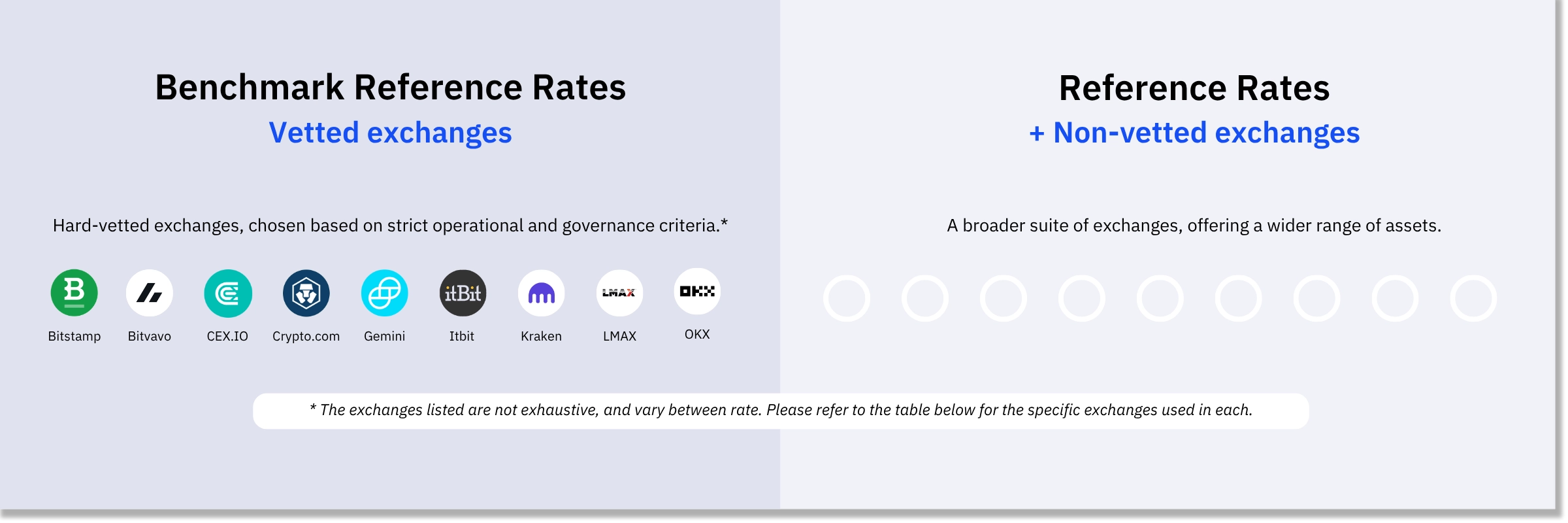

Reference Rates.

Asset classes

Crypto

BMR-compliant prices for all major cryptocurrencies and tokens.

Equities

Single stock prices from the leading equity markets around the world.

ETFs

Net Asset Values (NAVs) for the leading Exchange Traded Funds.

Commodities

Real-time prices for oil and other essential commodities.

FX

Foreign exchange rates for a wide range of global currency pairs.

Metals

Real-time prices for commodities like gold and silver.