Join us in Cannes for our Institutional Conference this Spring

Welcome to the index in focus!

Welcome to the Index in Focus! Today’s report focuses on our Market Indices: how we define these products, their evolution over time, and an analysis of their performance and outlook for the coming months.

-

Why does liquidity matter in index construction?

-

The differences in constituent assets between small-, mid-, and large-cap indices.

-

Performance & Outlook for market indices in 2025.

Introduction

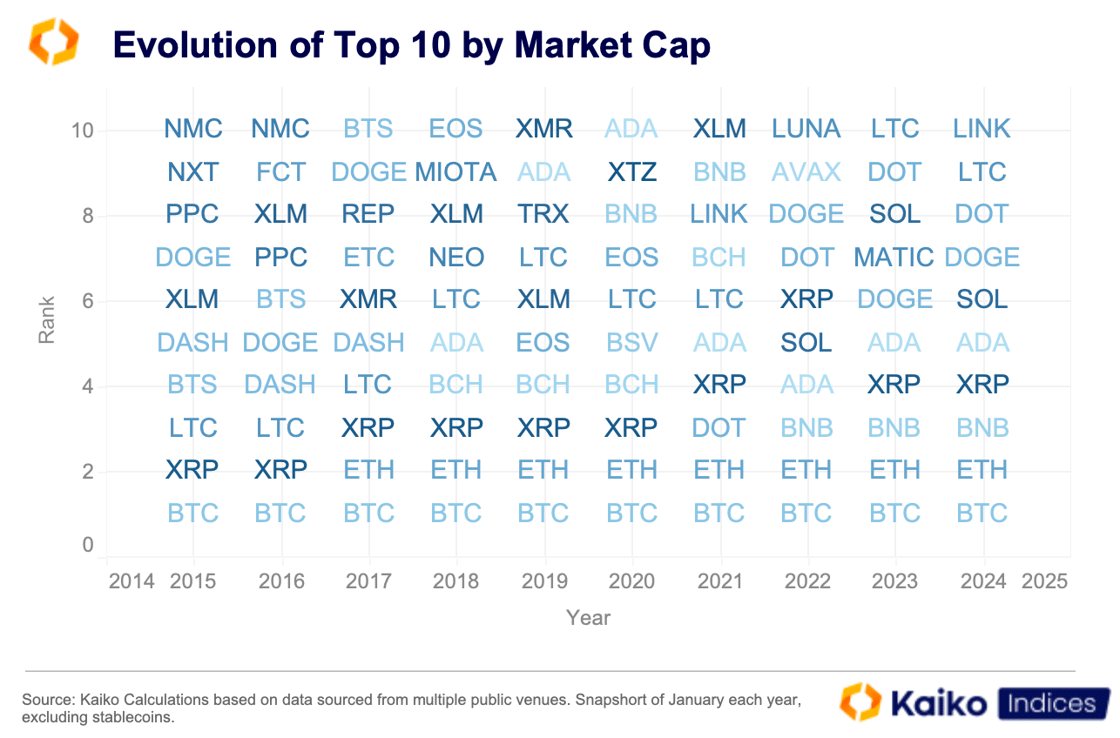

Over the past decade, the digital assets market has developed in a lopsided fashion. BTC has dominated the market as the original digital asset, but beyond that, there is considerable variety. The top 10 digital assets by market capitalization today are almost unrecognizable compared to those in 2017 or 2019. This variability in the leading assets by size and demand adds an additional layer of complexity when creating efficient market indices.

In this report, we explore how digital asset segmentation has changed over time—specifically, how the small, mid, and large cap digital asset segments have evolved, and why liquidity, in addition to market capitalization, is crucial to building these baskets.

Introducing Kaiko Market Indices

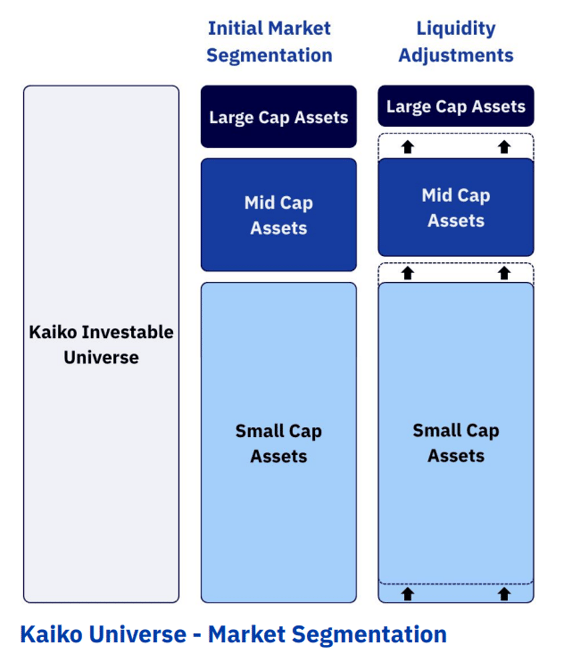

Each asset is assigned to a segment using a combined score that gives equal weight to liquidity and market cap—both factors are considered 50% each. Liquidity scores are based on trading volume and order book depth, while asset size is measured by market cap. Assets are ranked by their combined scores: large caps make up the top 75% by cumulative score, mid caps the next 15%, and small caps the remaining 9%.

To ensure tradability, minimum liquidity requirements are enforced. For example, an asset at a segment cutoff must have liquidity between 50% and 115% of the minimum threshold. If an asset falls outside these bounds, it is replaced by the next eligible asset in the ranking, ensuring each segment ends at an appropriately liquid asset.

Constituents Evolution Over Time

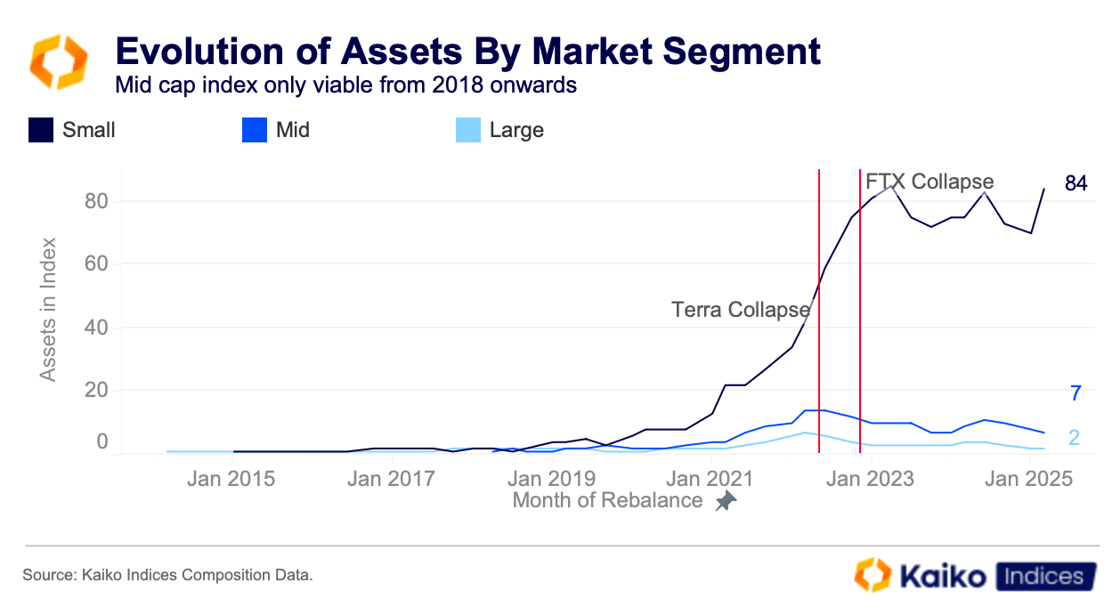

The crypto market is dominated by an abundance of small-cap assets, while quality large-caps are harder to come by. This is due to the lopsided development of digital assets, as noted in the introduction. The market has always tilted towards BTC, and this trend shows no signs of waning.

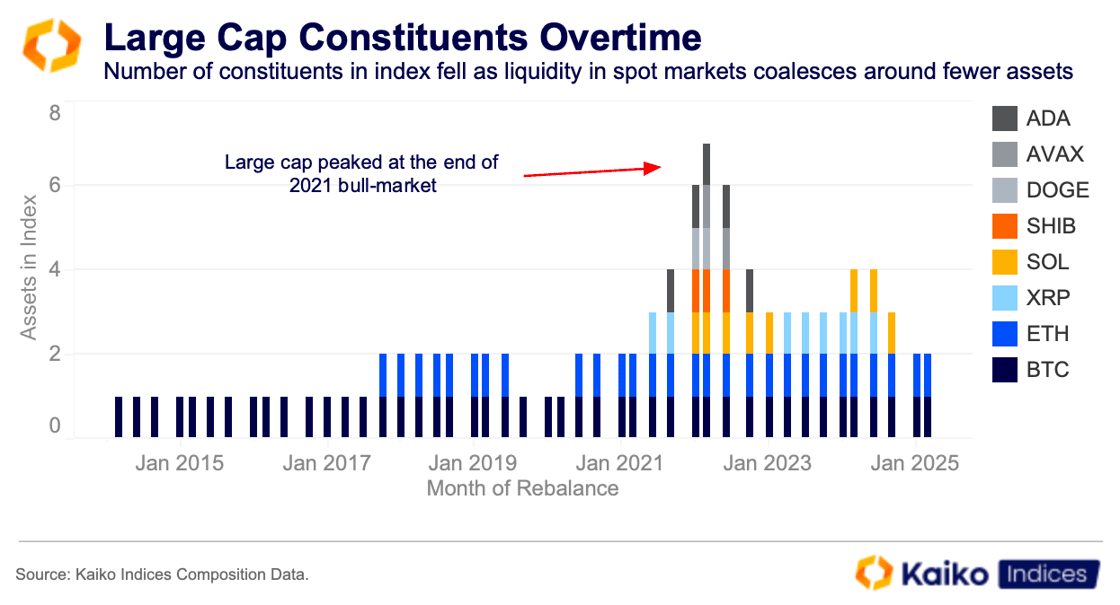

As such, the market has developed in two distinct directions, with large-cap and small-cap assets forming the two main segments over the past decade. BTC has been the only consistent member of the large-cap index, with several other assets briefly joining during the previous market cycle between 2020 and 2022.

This market was characterized by a distinct “altcoin season,” which led to improved liquidity in assets beyond BTC and ETH. However, the most recent market rally, since the latter half of 2023, has seen liquidity coalesce around fewer assets.

Since inception, many different assets have entered and exited the small-cap segment, which continues to have the highest number of distinct assets. However, the number of assets in this category dropped by 15% following the collapse of FTX, after three years of unprecedented growth.

A mid-cap market appeared for the first time back in 2018. Since then, the mid-cap segment has mostly been limited to a handful of assets. This is consistent with what we observe in the Kaiko Crypto Indices and supports our belief that the KT10 is the most viable broad-based index—a point we will explore in further detail below.

Why Liquidity Matters

Why don’t we simply look at size when we create these market segments? Essentially, market cap in crypto is rarely a good indicator of the ability to efficiently trade an asset.

Let’s imagine that Kaiko Indices created the large-cap index from the top 10 assets by market cap, ignoring liquidity. How would that have looked over time? There would have been around 28 different assets moving in and out of the large-cap index over the past decade—some of which are not even viable for inclusion in our investable universe, such as NEO and XMR.

Having a large-cap index with this much variability and change would have a serious impact on revenue for any product tracking it. Trading costs at rebalance would be significantly higher, not to mention slippage and the associated loss from selling illiquid assets that exited the index.

So, while the market cap approach would lead to an ever-expanding universe of potential large-cap products, in reality, the choices are narrowing.

The Kaiko Indices large-cap index has actually become more narrow over time as liquidity in spot markets has been funneled toward bluechip names. As previously noted, the large-cap index had its highest number of distinct constituent assets back in 2022, with a total of eight assets, but only when liquidity was sufficient.

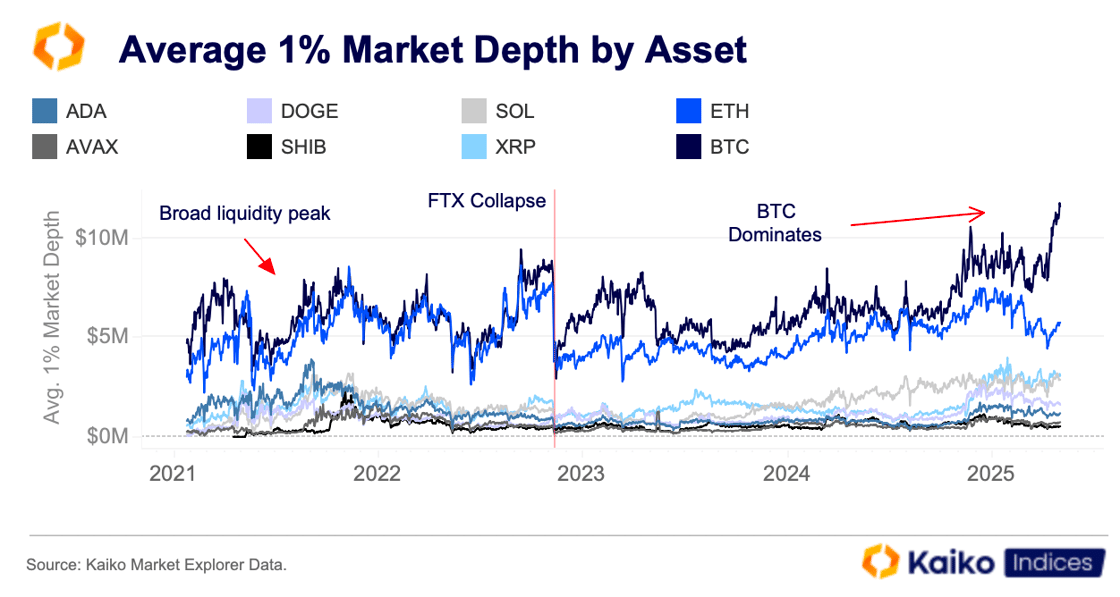

The liquidity profile for these eight assets has changed dramatically since then, as shown in the graph below using Kaiko Data’s Market Explorer tool. This approach differs slightly from the Kaiko Indices process for segmenting assets, as it does not filter by specific pairs; however, it offers a broadly similar view of the observed trend.

While each asset has seen its liquidity improve since the FTX collapse and the bottom of the last bear market, the recovery hasn’t been felt equally. BTC has again dominated and outpaced growth in these smaller assets.

During the previous bull market, BTC and ETH had similar 1% market depth profiles. Today, BTC has nearly double the average 1% market depth of ETH.

This uneven recovery helps explain the trends in constituent assets by market segment and why the large-cap index has become more narrow over time. It also reinforces the need to consider liquidity as well as size.

2025 Performance & Outlook

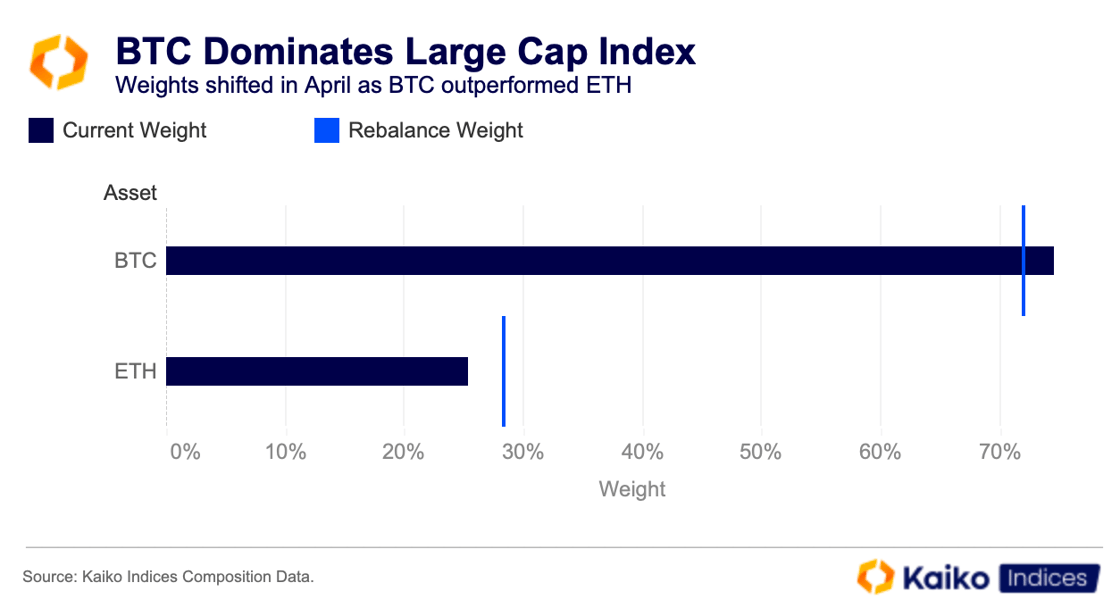

BTC dominates not only in terms of size and liquidity, but also in performance. The original digital asset has once again outpaced ETH, particularly in April, as it showed signs of decoupling from risk assets and behaved more like a safe haven.

This relative outperformance means that, despite a rebalance just one month ago, ETH’s weighting in the large-cap index has already fallen significantly. ETH’s share of the index dropped by 4 percentage points from its post-rebalance level, while BTC’s weighting rose to around 75% of the index.

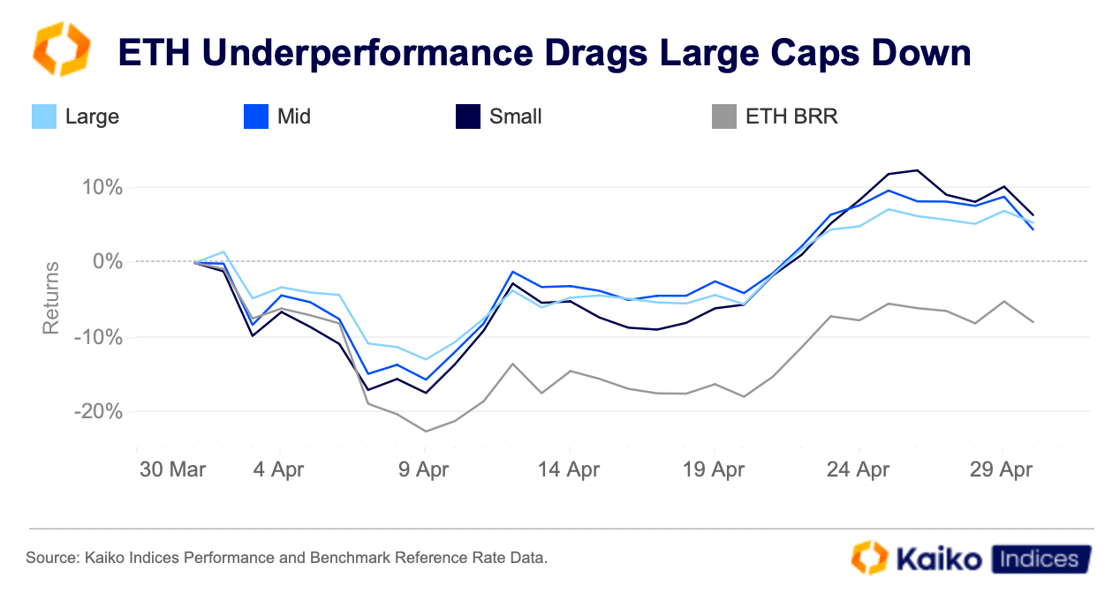

ETH didn’t just underperform relative to BTC; it also underperformed each of the Kaiko Market Indices. Our ETH reference rate, with London fixings, fell nearly 8% in April, while each market index posted positive returns. ETH’s underperformance dragged the Large Cap Index lower.

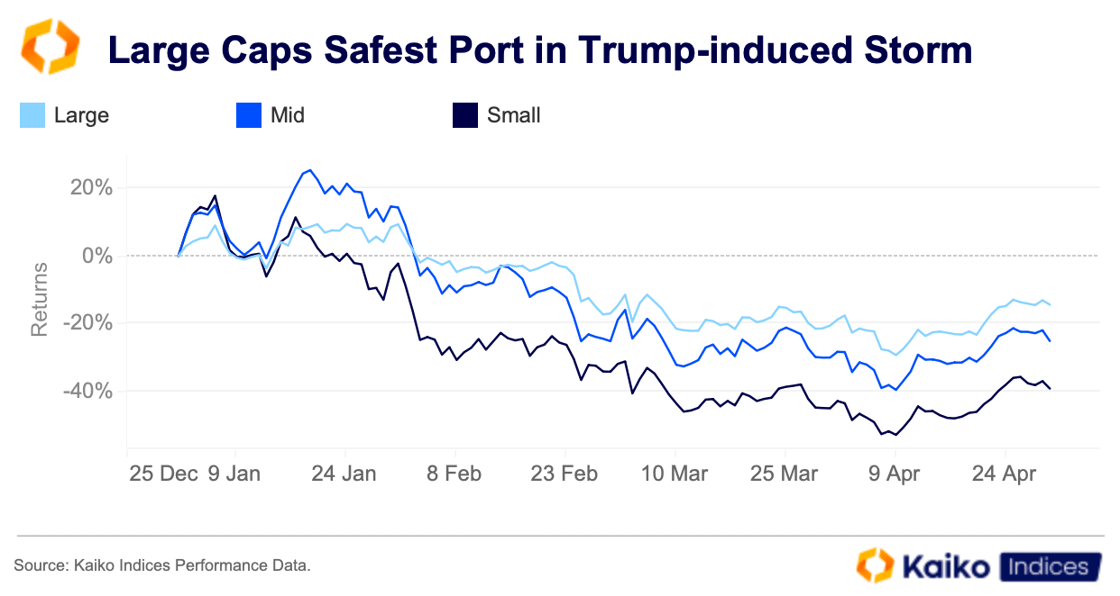

However, year-to-date, large caps have been the best performers among digital assets. While all three market indices have traded lower, the Large cap index has experienced a less severe drawdown than the others.

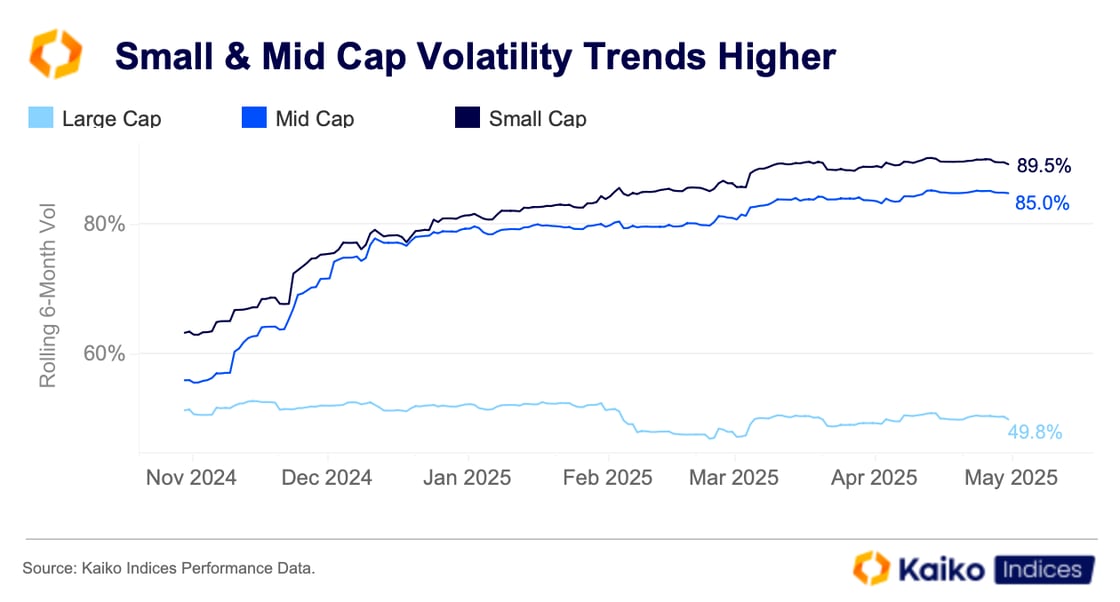

The Large Cap Index is also much less volatile than both the Small and Mid Cap indices—a difference that is, once again, tied to liquidity. The less liquid an asset is, the more prone it can be to sharp price moves.

Therefore, despite lower returns in April, the Large Cap Index still offers the best volatility-adjusted returns. This is likely to continue, as BTC’s realized volatility has been trending lower for several years now, reflecting its improving liquidity profile and the asset’s maturation.

While broader market factors over the summer months could still lead to an uptick in volatility across all three indices, the Large Cap Index will be starting from a lower base.

Conclusion

The Kaiko Market Indices were created with the idiosyncrasies of the nascent crypto market in mind. By prioritizing liquidity and market capitalization, we aim to avoid the pitfalls of purely size-based indexing and ensure that each segment reflects real market tradability.

The narrowing of the Large Cap Index and the dominance of BTC reflect trends in spot markets, where liquidity continues to concentrate in a few resilient assets. This dual-factor approach has not only improved index stability and reduced turnover costs, but has also led to better risk-adjusted returns, particularly for the Large Cap Index.

As crypto markets evolve, maintaining this balance will be essential for constructing meaningful and investable benchmarks.