Spotlighting crypto market abuse with data.

Kaiko x Moodys: Spot Crypto ETFs Draw Institutional Interest, Despite Risks

A collaborative research report powered by Kaiko data.

May 1st, 2024

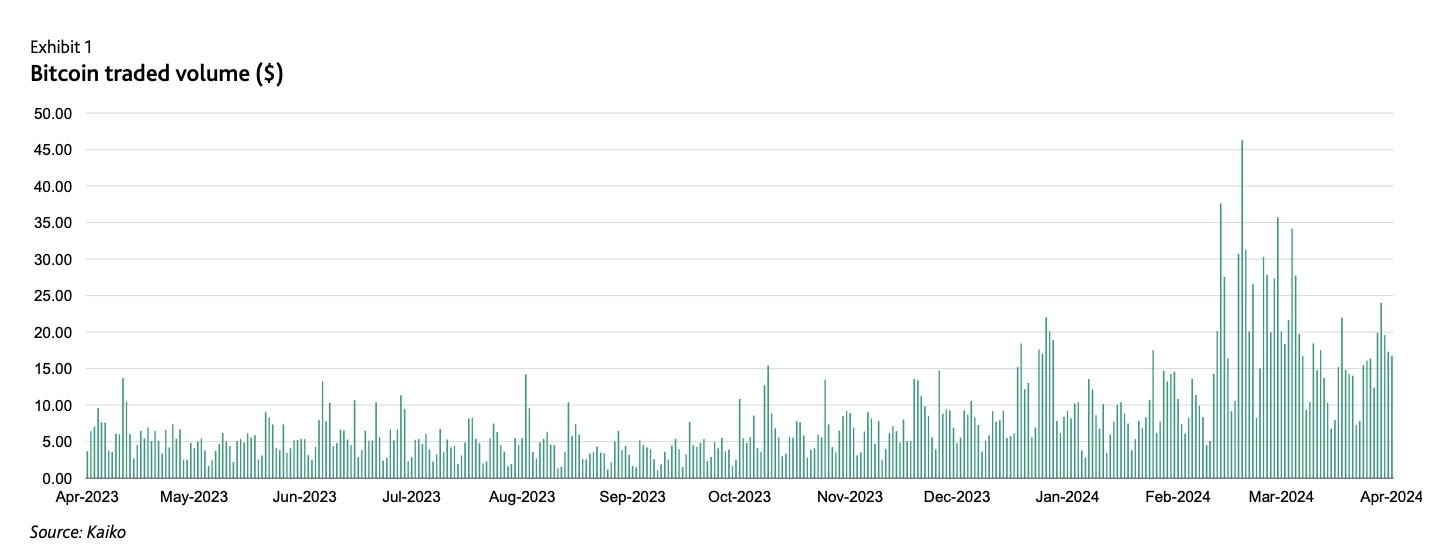

Volumes of spot ETF trading have surged globally since the launch of ETFs. Since 11 January, Bitcoin trade volume has hit multiple new multiyear highs, at one point topping $46 billion.

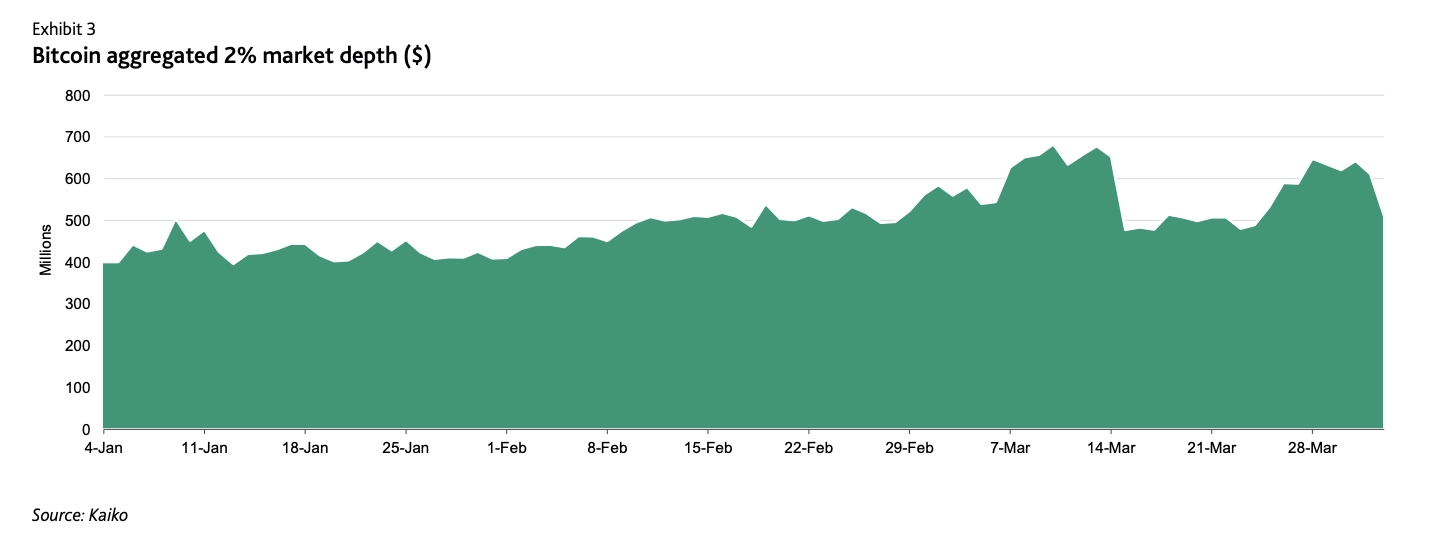

Bitcoin liquidity has increased since the launch of spot ETFs. Since January, as measured by market depth – the quantity of bids and asks on an order book – Bitcoin market depth has surged from approximately $400 million to roughly $500 million across all exchanges.

ETFs can amplify market downturns. If there is an event that triggers large outflows, ETF issuers will need to liquidate their holdings, which could weaken values in crypto markets.

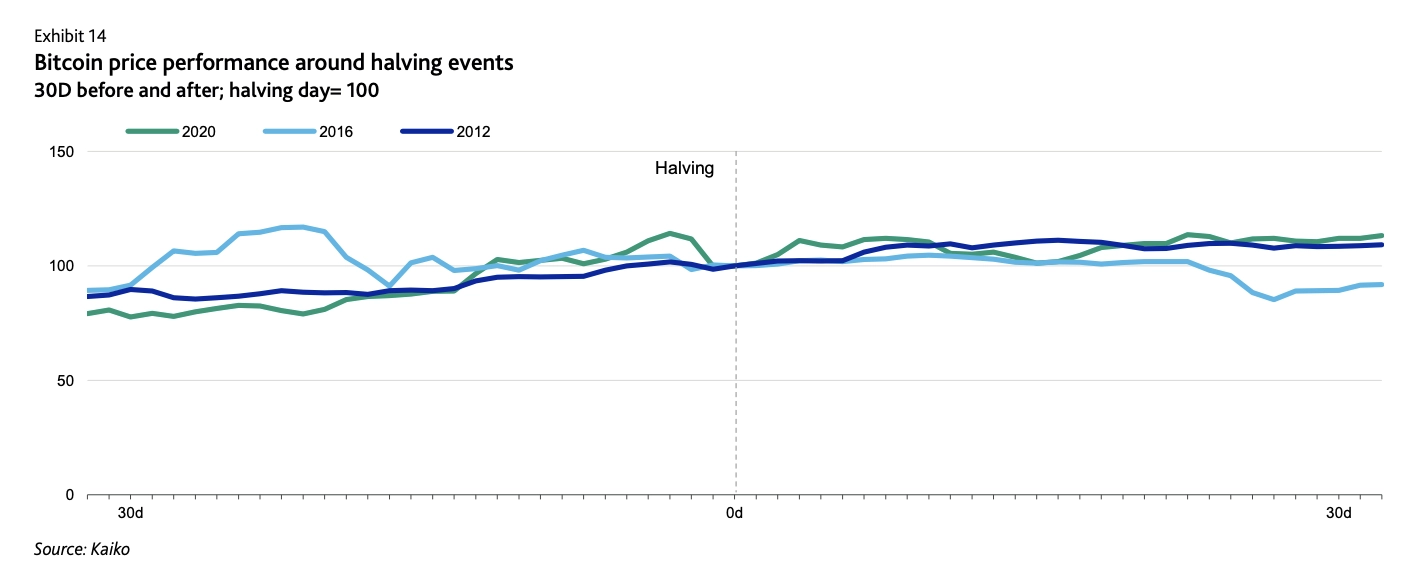

Bitcoin’s halving will likely be positive for its price, if spot ETF inflows remain strong. The launch of the spot ETFs has created a sharp reduction in Bitcoin’s supply. Should ETFs continue to generate large inflows, there will be a bullish impact on Bitcoin’s price posthalving.

Download the full report here and visit Moody’s website here.

Never Miss An Update

MORE FROM KAIKO

![]()

Company

New York

Kaiko Partners with Cumberland to Build Critical Data Infrastructure on the Canton Network

Kaiko today announced a strategic partnership with Cumberland’s Denex to build critical data applications on the Canton Network.

25/06/2025

Read More![]()

Company

New York

Kaiko Becomes a Strategic Partner on the Canton Network

Kaiko has been voted Super Validator, joining the group of entities governing critical software upgrades and configuration changes for the Canton Network.

12/06/2025

Read More![]()

Perspectives

Paris

How market surveillance solutions can help regulators prevent crypto price manipulation

Learn more about the role of market surveillance in helping regulators tackle market abuse typologies like wash trading and market manipulation.

11/06/2025

Read More