Spotlighting crypto market abuse with data.

Kaiko Fair Market Value.

Our Fair Market Value Pricing aggregates data from 100+ exchanges ensuring you always get a consensus price that is stable, outlier-resistant, and representative of the market.

Fair market value (FMV) for compliance

IFRS and GAAP-compliant valuations, achieved with an advanced methodology that’s backed by peer-reviewed research and our trusted market data.

Generate reliable, auditable prices from the most liquid venues, with instant access to underlying data for transparent audit trails and streamlined regulatory reporting.

-

All Crypto Assets

Source prices for thousands of assets. If it’s traded, we cover it. -

Direct or Synthetic Pricing

Compute accurate valuations for both high and low liquidity pairs. -

Flexible Data Frequency

Pricing in increments for your needs. From second-by-second updates, to daily refreshes. -

Any Fiat Conversion

Convert your price from USD to over 100 global fiat currencies. -

Oanda Conversions

Get IFRS-compliant fiat conversions for synthetic prices with an optional Oanda FX add-on.

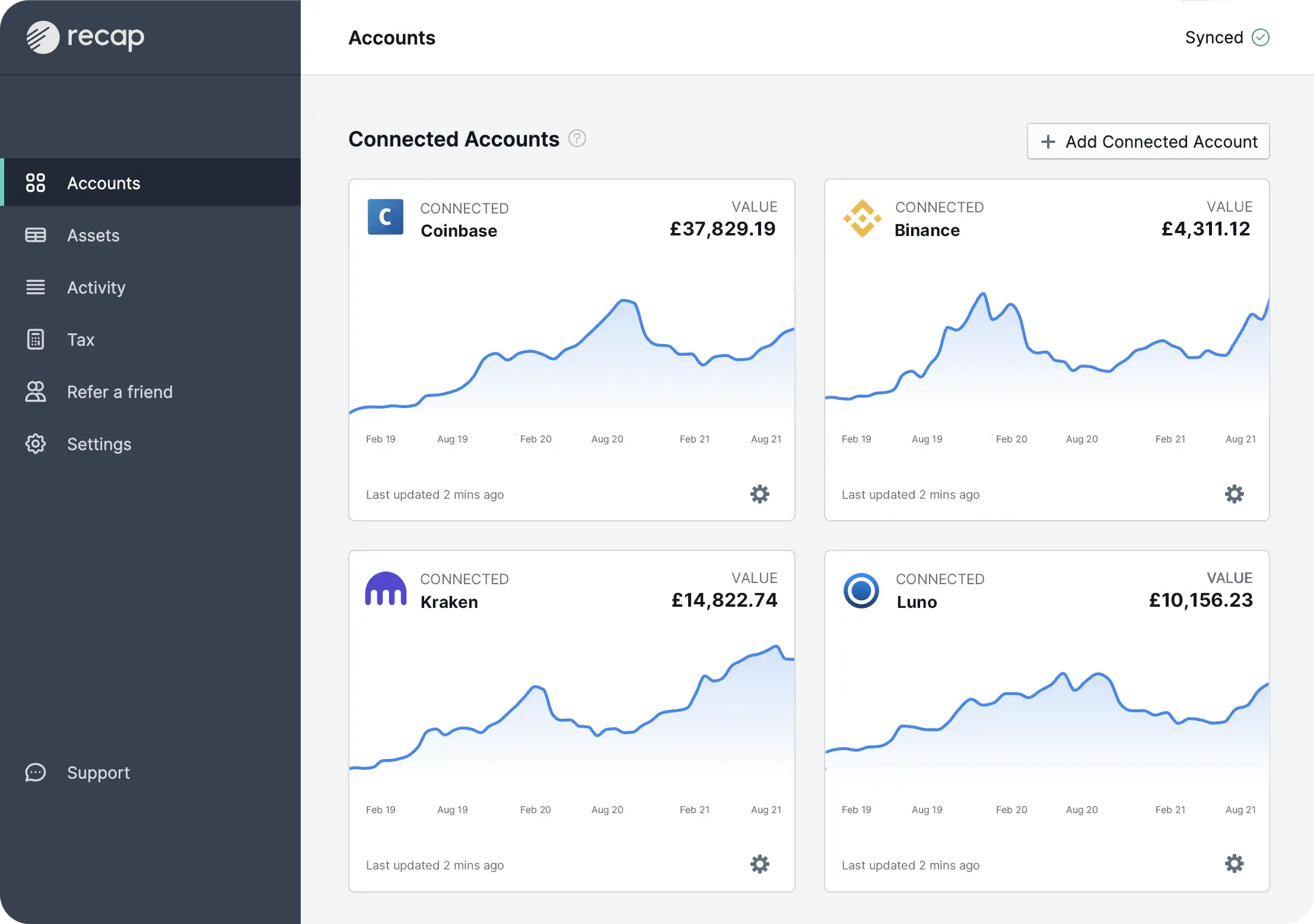

Client Story

Learn how tax software provider Recap.io leverages Kaiko Fair Market Value Pricing for crypto accounting.

They needed a Fair Market Value (FMV) and audit trail for crypto assets.

Our methodology provides a compliant and fair price for their clients.

valuation GUIDE

Download our practical guide “The Unspoken Importance of Accurate Crypto Valuation”

Learn about custodians’ compliance responsibilities for ensuring Fair Market Valuation (FMV) of client assets.

Discover why Fair Market Valuation (FMV) is essential for brokers to meet best execution requirements under MiCA.

Ready to Get Started?

Learn more about how Kaiko Fair Market Value can power your valuation compliance strategy. Schedule a call with our expert team today.